Folks:

I wanted to get out my levels and thoughts for tomorrow a little earlier than usual as I have to head out in a few.

Session Recap:

My primary thesis today was being bearish if we opened/offered below 4650 and being bullish if we opened/bid above 4650. We opened below 4650, however by the time Cash session opened for business, my target levels had been already hit.

I then sent a follow up Twitter post , a couple minutes before cash open, with 4646 as potential resistance and 4600 as being potential support. We traded down to 4600 shortly thereafter for a 40+ point zipper .

Once we traded down to 4600, I was bearish at the lows due to heavy lots trading on the bids and reiterated this in my post here Toc 4600 More Sell

Finally around 10 am local time, I became bullish at 4560 as I felt TRIN was extreme at almost 3 and we are now trading about 40 handles up from the lows of the day , now 4596. This is as of 11 am and could change as remainder of the session plays out. 4597 is a key level.

My Plan for Tomorrow:

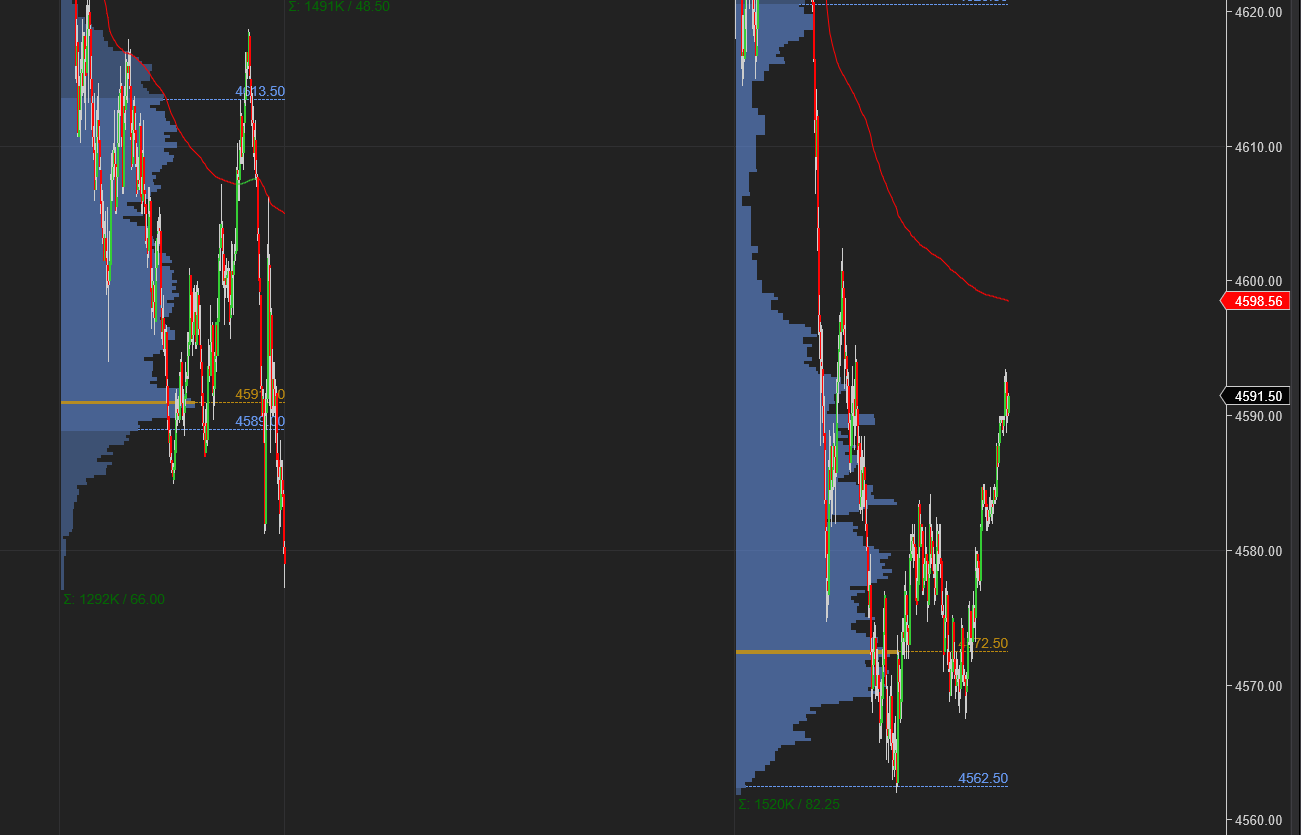

Right now I am quite binary in remaining intermediate term bearish below 4600. I think the values are progressively moving lower. Breakouts are failing and get sold after falling back into the value areas. See Figure A with volume build up right under 4600 which may play a key role in tomorrow’s auction.

From a fundamental perspective, while I think omicron variant is a non-factor for the S&P500 , today’s Powell testimony is pretty damning and disheartening for any one wanting to be bullish.

Then there is the question of month end rebalancing . Using relative performance, it does seem money is flowing into safe haven stocks like AAPL and TSLA, both of which are my stocks and did very well on a day like today. TSLA also has a rumored stock split coming up next week so that may be a factor as well.

Today is a very high volume day, on track to be a 2 million + lot day. I always keep track of such days as they tend to play role of support and resistance , days and weeks out.

With this backdrop, I put together the following 2 price scenarios for tomorrow:

Scenario A: For Bullish auction, in my opinion the following needs to line up:

An OPEN above 4600 with TRIN values in healthy range of 1 or below. If we get to open above 4600, and shortly bid above 4620 , this will be a bullish opening for me with opportunities to lean against dips at 4612-4620. My targets in this case will be recent order flow pivot at 4650.Scenario B: An open or a market that opens above 4600 but gets offered below 4600 may be a bearish scenario with the rallies being sold on rips.

This scenario may get amplified if TRIN opens below 1 but starts crawling above 1-1.5 range. Any prints into 2 + range will be extremely bearish for me, given the current context. My target will be a retest of 4540 . Now while 4540 , if we get there, is a solid support, that doesn’t mean I will blindly buy it. See context from my Weekly Post 2 days ago why S&P500 sell off may turn to a rout below 4540 due to the contextual importance of that level.

This is it for today’s plan. I am trying to get out at least 2 , if not 3 posts on order flow before the holidays and should hopefully make for fun Christmas weekend reading 😊for subscribers. Stay tuned, more on that later! As always, feel free to share the post and subscribe if this added value !

As always, if these levels get hit overnight, updates if any will be issued on my Twitter and Telegram early AM 👍

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Hey Tic, first off, like to thank you for all the value you provide for the price you do. I'm trying to learn how to fish on my own with your guidance...I have a few questions, as I've set up my volume profile on TOS. Few questions if you're willing to give us your secrets and spend your valuable time...

First question-do you include overnight sessions in your analysis? Currently my levels do. Please advise.

Importance of 4600-I see 4602 as the top of pullback during Tuesday's downtrend at 8:15 (pacific). Was 4600 just rounding down for that top?

Importance of 4620 to be bullish- 4622 was VAH from Friday and VAL from Monday. But it was also the top of the pullback of the down trend that occurred in the overnight session on Monday night and support during Sunday night session

Willing to buy dips 4612-4620, if bid was above 4620: 4609 was VAH from Tuesday session and a point of support and resistance and 4620 as noted above.

Importance of 4650-point of resistance back to Monday

Importance of 4540-Previous low that /ES hasn't broken below that occurred on 10/27?

“Breakouts are failing and get sold after falling back into the value areas.”

“ always keep track of such days as they tend to play role of support and resistance , days and weeks out”

Teaching and guiding us at the same time 👌🏼