Folks -

Nearly all of data today was weak and pointed to an economic downturn- from the core PPI to the PPI to capacity utilization and Retail sales came in way weaker than expected.

From a S&P500 Emini perspective, we opened at 4020 which was above 3990 and shortly tested 4030 level. In fact overnight the market remained quite supported at 3990 before testing 4030 today at the cash open.

4030 however did not hold and we sold down back to 3990. It is here when we saw the intraday closes below 3990 that the Emini S&P500 shed another 50 handles to close near 3950 key OrderFlow level at Chicago cash session close.

The sell off today also did get a lot of help from the FED speak which came in as very hawkish.

The action today brings us to the doorsteps of the Weekly pivot. Here is my weekly plan below if you have not yet read it. This is a good plan, spend some time reviewing it.

Publication goal is not to become a signal service. There are several hundred signal services out there - this is not one. My primary goal is to share my thoughts and key levels - there are readers here from many time frames and many backgrounds, I think it is very hard for me to cater to any one specific style or time frame. Mostly Daily plans are catered to the intraday time frames and the weeklies are usually geared towards longer time frames from weeks to months to year.

Based on the auction today, there were a few contradictory signals for me personally. While the action in the stocks was bearish, I thought the bonds action did not complement this sell off. Is this start of a new relationship between the bonds and the stocks ? We need more observation to back this claim.

I think on the weekly time frame, the action today serves to send confirmation signals of bearish continuation of this. I think if the bulls can not close a few sessions above 4060 this week, I think this could target 3800s followed by 3600- again some thing covered in detail in my weekly plan above.

Tomorrow not much US risk but I will keep an ear out for what the ECB chair says. In conjunction with the WEF meeting, comments from Lagarde may be important especially if they are in sync with what the US based FED governors have been saying of late. A hawkish Lagarde could add to pressure on the S&P500.

My key levels for tomorrow will be 3950 and 3990.

Scenario 1: If we open or remain bid above 3950, we could target 3980-3990 area.

Scenario 2: An IB close below 3950 could lead to more sell off to next support 3910 area. We are now trading around 3950.

To reiterate the weekly level thinking-

We have now sold off towards the key Weekly LIS and the bears will need to maintain pressure here.

For the bulls, if they can keep the market bid above 3950 tomorrow, they could lead to a retest of 3990-4000 area .

Longer term I think 4060-4200 remains robust resistance with support come in around 3800. However to get there, the bears need to keep pressure on here at 3950 and not let the Daily close above 3950s.

Then the other key question for me will be that are the stocks now permanently broken up with the bonds or can they catch up? With the nasty data today, I think the bond market is correctly calculating that the FED will be forced to lighten up - may be even start cutting before any one expects. This FED does not have a lot of political freedom and I think the bond market is right.

Now the question is - will the stocks catch up to the bonds? I personally think that the bonds are more oversold than we could continue to see outperformance in the bonds compared to the S&P500 IMO. However in the short term , if the bonds remained bid up, it could support stocks too.

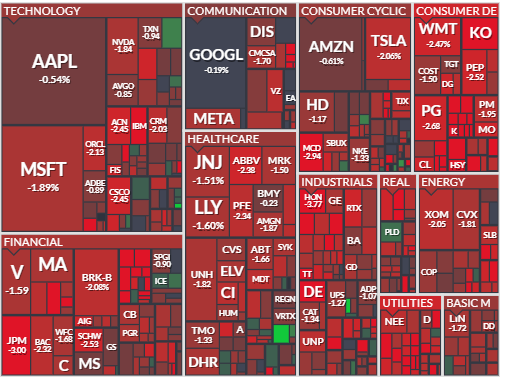

Some other risk on names like TSLA also sold off today in sympathy with the rest of the market. My key level on TSLA is 126-127 and I think this may be a key level/support. If 126 holds, I think we could retest 135. Below 126, the next level of support may come in near 118-120.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.