Traders-

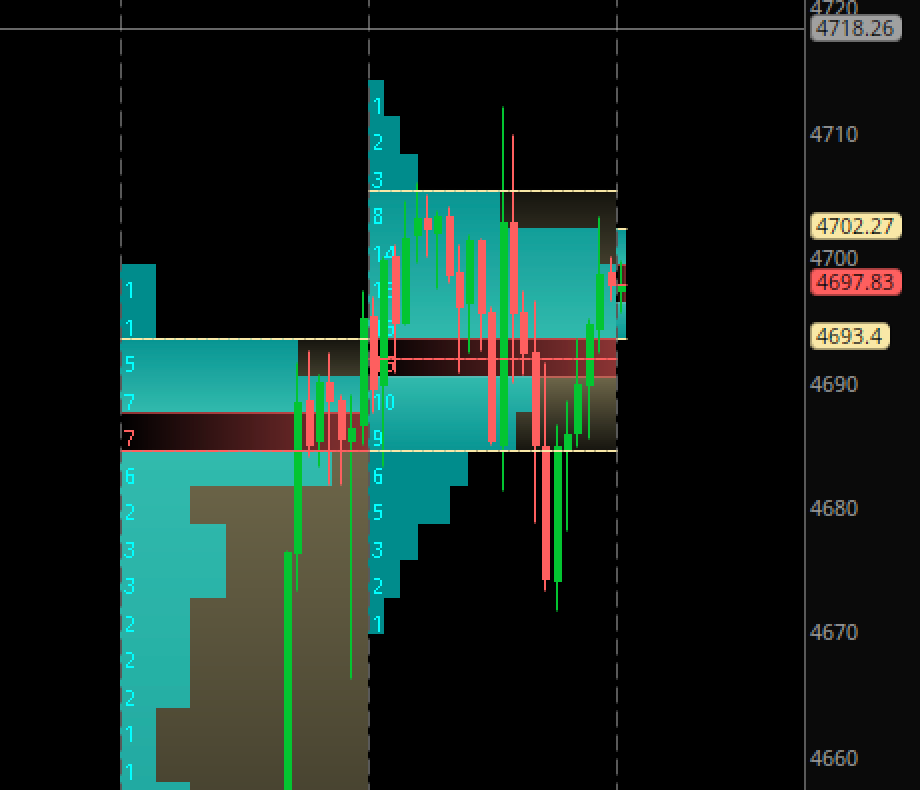

Very slow day today, coming on heels of such an active week and a half. About half an hour before the open today around 6 am, I called out this to be a balanced day at 4693. For most part we spent entire day below my 4693, with low of the day around 4670. 4693 broke in last half an hour of trading to bid as high as 4700. See below.

Few other names that did well were shared by me earlier:

DWAC: This is what I shared at 43 on Monday, now trading 65 bucks.

TSLA: Tesla also did quite well from my 965. Trading all the way upto 1075 and change.

AMZN: I shared this at 3380 and was trading 3525 and change last I checked.

RBLX and NVDA: Both my top stocks from last month did quite well once S&P500 bounced. Solid bounces off their respective orderflow supports shared earlier (110 and 293 respectively). However, I am a little concerned about NVDA not being able to hold 321. At the moment it is trading 318. At any rate I do not want it to lose 310 handle and rather take back 321 in next day or so, else it may open a path to retest of 280/292.

Home Depot HD continues to perform well from my support levels (405).

CME: I shared this at 218 before a breakout to 232. If volatility picks up for next 3-4 months, it may be good for this stocks. I could play this with CBOE as well but I like CME a shade better.

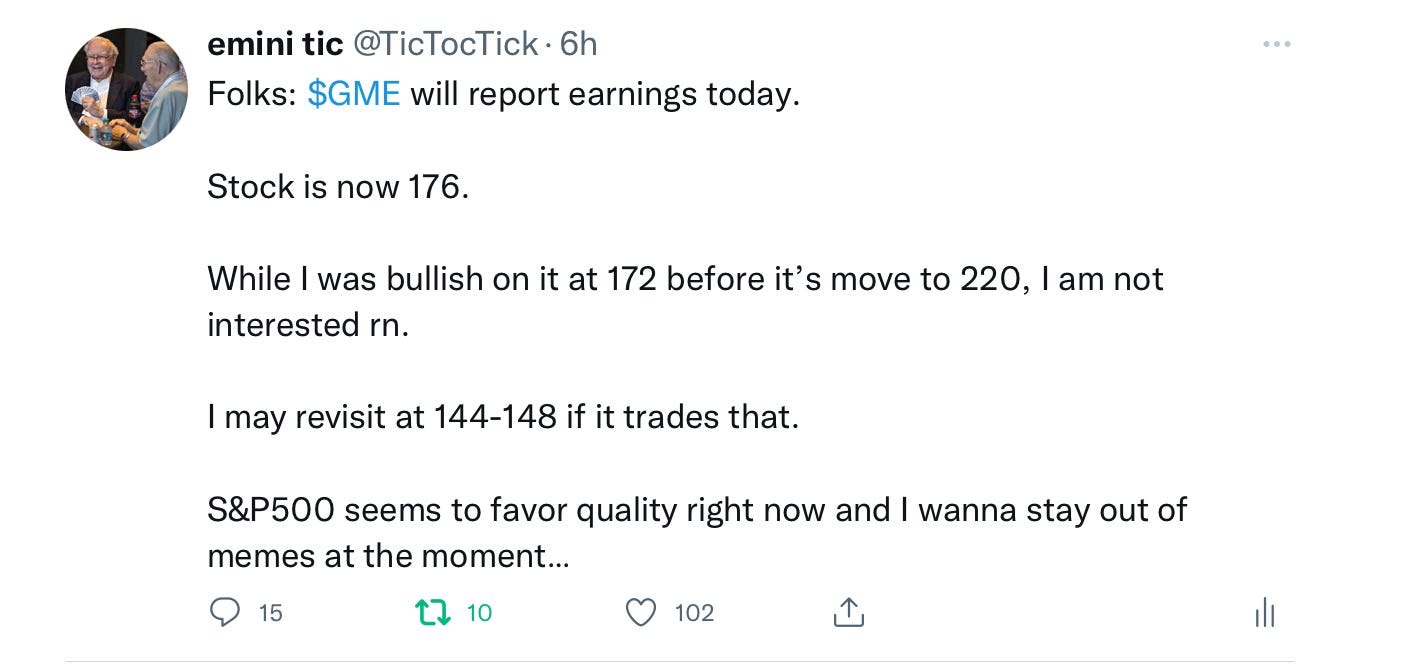

On the earnings side, I was lightly bearish on $GME at 176 today which fell to about 162 after hours but then got bid up again. I like 144-148 on this stock, that is if the dip buyers let it get there.

One stock that had very good earnings is Toll Brother TOL. It also broke a key resistance and held the break out. I like it as long as it holds that 67/68 zone. At this minute it is trading 72 bucks.

For Tomorrow:

From a 10,000 feet view, S&P500 is very close to ultra key 4710/4720. It can break out of it BUT it will require tremendous force to do so. Will that force come this week or what remains of this week is an open question.

Next Wednesday, the 15th is FOMC day. FED , along with other Central banks of late has got into a habit of being more hawkish than expected as they try to squash the inflation phenomenon and consequently stocks tend to sell off after each FOMC . So there is that, but that is 5 sessions away.

So, now let us dive deeper into the session today and see if we can form few price scenarios for tomorrow.

See Figure A for a completely balanced session , resting on top end of a very strong Tuesday.

I did not see any one side particularly dominant over the other throughput the day. Just a slow churn and scalpers dueling it out for a few points at a time.

The low of the day was very close to my orderflow pivot 4667. This is also the highs of previous week so adding some level of cushion to the natural orderflow support.

With this context and background here are my key price scenarios:

If we open below 4696 but above 4670: I expect a continuation of the session today, with more balance like conditions and rotation between 4667/4695. I will expect larger moves only upon an intraday close above 4695 or below 4667. Such move may target 4710 on the upside and 4643 on the downside.

An open above 4696 may target 4712-4720 and make up its mind about next steps there.

S&P500 emini is trading 4696 at time of this post.

This is from me for now. Will be back with more later.

Today's plan in case you missed it..

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Mr. Tic, today's after close analysis & tomorrow continuation, what a perfect explanation, thanks.

Thank you