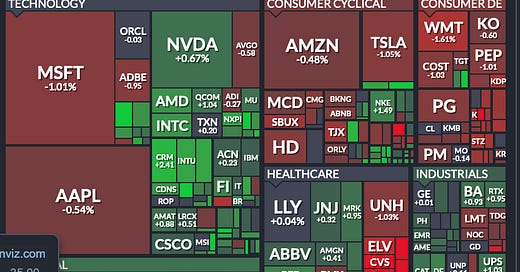

Little bit of conflicting signals on the tape with some names rallying hard whereas the index being soft.

We saw good sell off from 4600 but unable to see follow thru below 4550.

Tomorrow the main news event is the PCE index along with month end flows.

In last couple of weeks, we have now seen a total of 3 rejections near this key level of 4600 which keeps the bulls on their toes.

My key levels for tomorrow:

It will be 4565. At time of this post we last traded around 4565.

Scenario 1: I expect the market to remain on the soft side below 4565, to target some of the weekly targets near 4530.

Scenario 2: I think the bulls will need some help from the likes of AAPL to clear above 192 which in turn could bring some support above 4565 to make another test of 4600.

In related markets, TLT closed near 93 today. It is an interesting level and I think unless we overcome 94-95, we could see a resurgence in yields which have been enjoying a downdraft of late.

Outside of this, I think the action in the cyber security space looks like quite decent, in particular names like CRWD & PANW etc, however for them to retain momentum, they will need some help from the main index.

I also thought action in CRM was very strong, the stock was up like 20 bucks after hours, however this had a muted effect on NQ. It is things like this which are a little mixed bag for me as I would have expected far stronger reaction in NQ.

~ TOC

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Yahoo, Google. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.