Hi Folks:

Today’s session can at best be described as multimodal where the market searched for fair prices and could not find it all day. Powell’s renomination to the FED was an unexpected event as the market had priced in more dovish candidates.

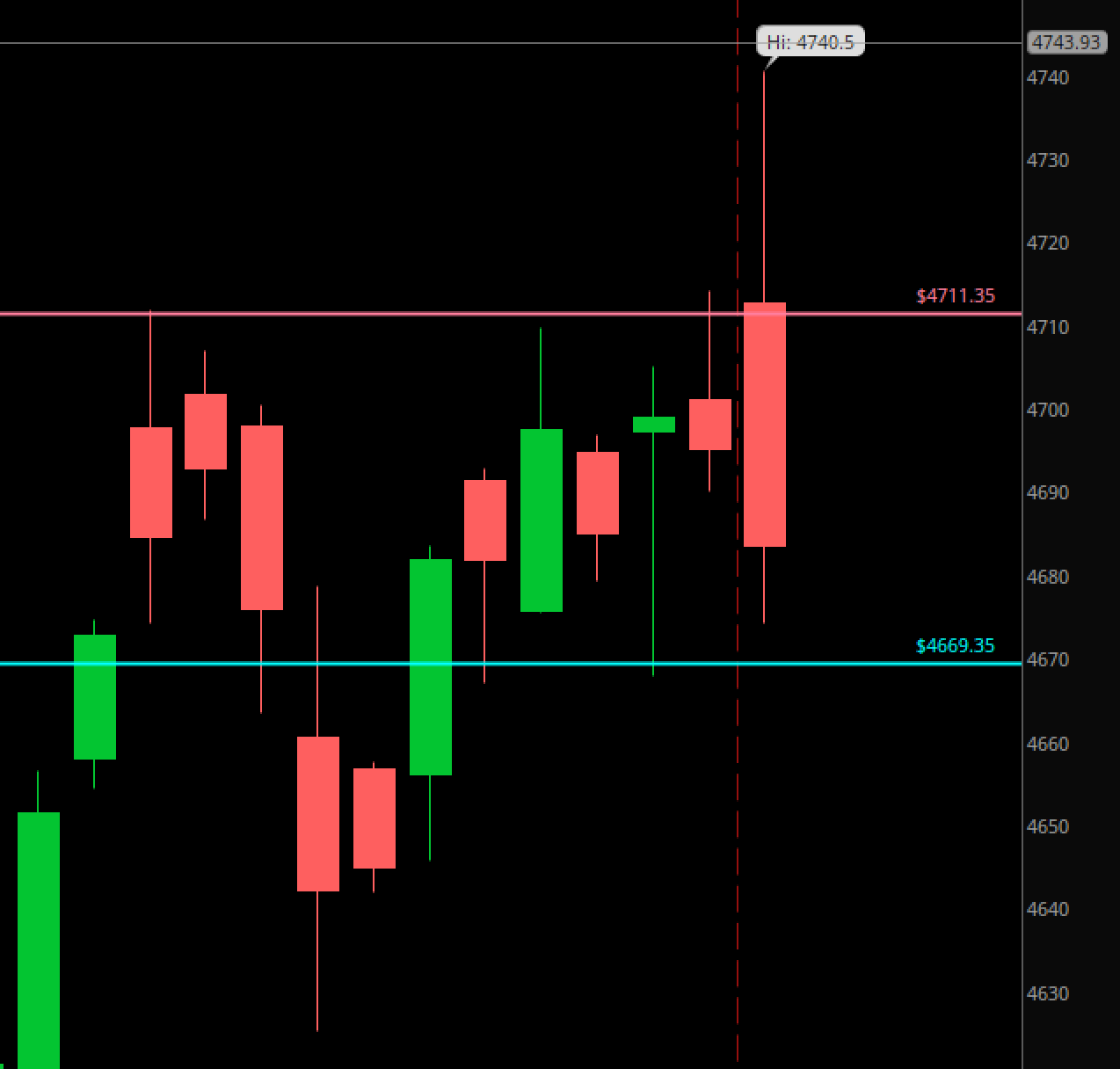

I was myself quite bullish at the start of the week and today’s session. See yesterday’s weekly trade plan for additional context. We went from my order flow level 4696 all the way up to 4740, making new all time highs. At 4740, with Jerome Powell renomination news hitting the wires, we started selling off.

Intraday, 4696 held the downside on the first attempt that was made to take out the lows and was good for about 35 handles.

A second attempt made to take out 4696 was successful and led to market venturing into 4678+ prints.

My take on Powell’s renomination:

In my opinion, the rates are not going to change, while the language of the FOMC may change. In that context, it doesn't matter who the FED chair is. Nevertheless, Mr Market wanted someone much more dovish than Powell (I did not know that was possible!) . As a result , a lot of high growth, Low/No earning names sold off. In NASDAQ, about 400 stocks made new 52-week lows. This is quite high, especially when only a 100 made new highs.

Looking ahead, this trend may persist for a few more sessions. And the direct beneficiaries of this trend may be the TOP 10 stocks in S&P500 which are: AAPL now 161, MSFT now 340, GOOG now 2940, FB 341, NVDA 319, TSLA now 1150, HD 405 etc. I think there is uncertainty around growth names and I would rather avoid those for now and focus on the most liquid, most mega cap names in S&P500.

Impact on other markets:

A) Gold: Every time Powell related news comes in, Gold is the first in line to sell off! As if the Chairman will now be able to correct the mistakes of the last two decades and set the rates on course to be 4-5 % within the next year or two. I do not think Gold sell off is serious, unless we start seeing daily closes below 1780-1800. At the time of this blog, Gold bid $1803 dollars.

B) Crypto: Bitcoin also sold off on this news, though not as much as I thought it would. Bitcoin trades much more like your regular growth stocks , however of late it is developing a personality of it’s own. I think Bitcoin bears will have a hard time being able to offer the coins below 54000-55000 handles. At the time of this blog, Bitcoin was offered at $56500.

My Plan and Levels for tomorrow:

My main thesis for tomorrow is a continued weakness in high growth names with potential buying in mega caps. This thesis will be wrong IF I see TOP 5-6 mega cap names open down 1-2 percent and begin to sell off.

With this context, I will be keeping an eye on 3 scenarios tomorrow:

My primary expectation is an open between 4680 and 4710 with a balanced day like characteristics with a tendency to take out the 4710 level late in the day. I remain bullish on S&P500 unless we achieved a daily time frame close below 4670-4680 on large volume (1.8-2.2 million lots)

An open below 4680 may be a bearish open for me with targets 4660-4665. If this scenario plays out, I will keep an eye on mega cap AAPL, TSLA, MSFT, AMZN, GOOG. Given the current context of bad breadth and mega caps holding the overall market, I do not want to see these names sell off more than 1-1.5% which may lead to more selling in S&P500 below 4660.

An unlikely open above 4710 may set up for a trend day targeting the recent highs at 4740.

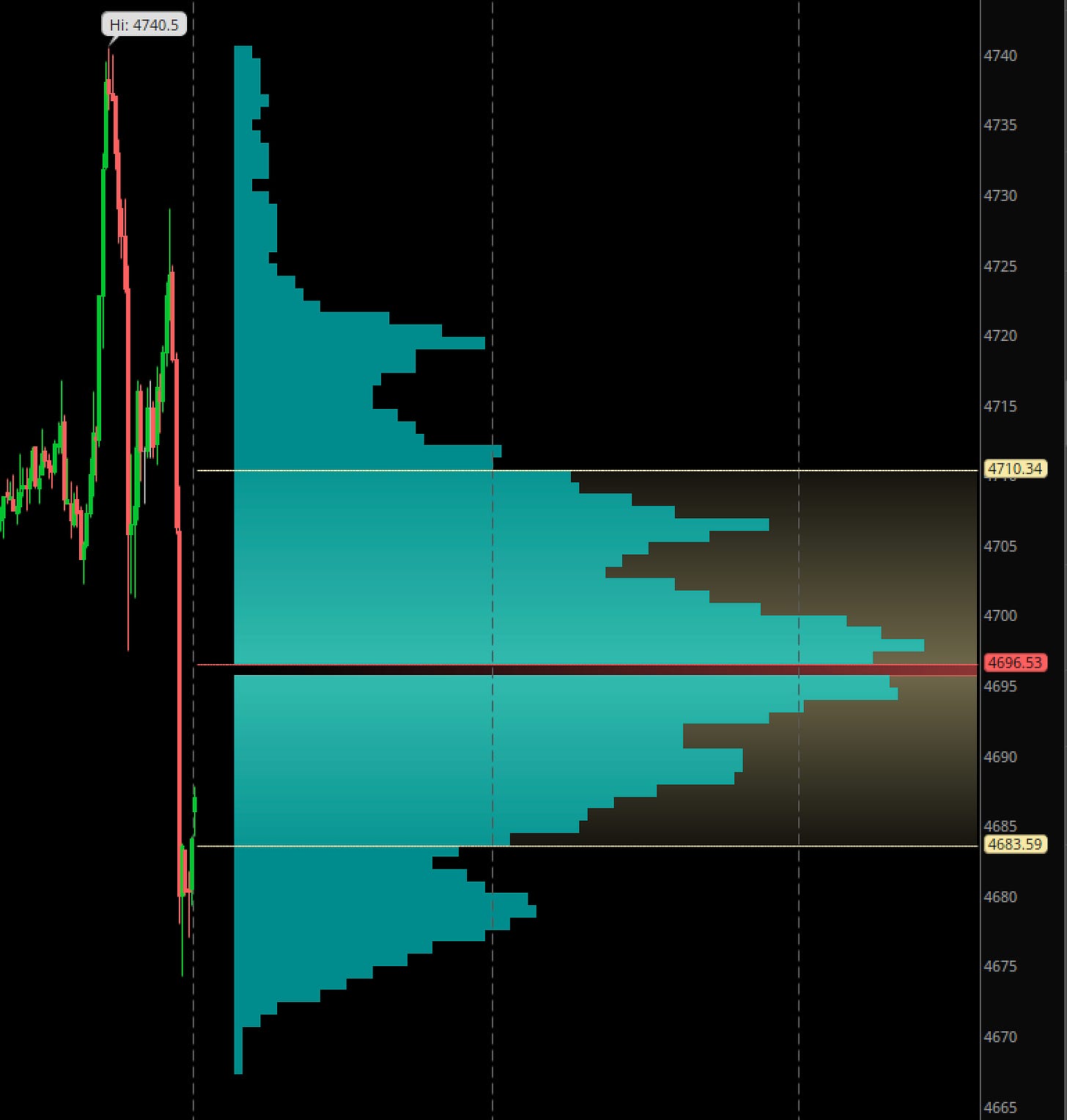

See Figure A below for current weekly auction parameters. You can see the market has failed to carve out a value outside of the value-area in recent days. I do not think this market gets a directional move either on the upside or downside, until and unless we get a clear daily close outside of these parameters.

Scroll down to Figure B for a 3 week auction with balanced conditions.

Figure B with a 3 week auction, the market is just stuck in a narrow range of 4670-4710, awaiting a high volume breakout day. S&P500 Emini at 4685 right now.

I am working on an additional post regarding growth stocks like SQ which IMO have taken an unjustified beating today which I will send under a separate email shortly either tonight or tomorrow. Stay tuned! Make sure you subscribe to my newsletter so you remain on top of any further updates!

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Thank you for sharing!

You are a 1 in a billion kind of person.

Thank you very much... appreciate...