Folks:

I am back with some more notes from the trenches. Below were my picks from yesterday’s trade plan and how they fared today.

Those in a hurry to read about S&P500 levels should scroll down to Section C.

A) Summary:

AAPL: I shared this yesterday at close. My target was 158 bucks which was met. iCAR news was just an excuse, I think the stock had been setting up for a move ever since it failed to close below 144 multiple times last month.

NVDA: I shared this yesterday after the EPS at 303. My target was 325 which was met today. Some of these chip stocks have run too far, too fast. I will be reassessing some of these chip names over the weekend and updating, sharing my new targets. Some levels on the downside as well.

PFE: Not much action today, continues to coil for a breakout towards 62-63.

HD: I shared this at 350 earlier in the month and reiterated at 390 a couple days ago with a target of 420. Stock just traded 405.

AMZN: this one was amazing! I shared this at 3340 and reiterated multiple times at 3500. My target on AMZN was 3700 which was met today. I think as long as 3500 holds, we go higher.

In addition I was bearish on several crowded stocks. Here’s how they fared and some notes on where they may be headed:

ROKU: I remained bear on this after my target of 265 was met yesterday. This was in hindsight the right move as the stock dipped as low as 235 today. My target is 225 bucks on ROKU. I think rallies, if any, get sold. Let me know on Twitter what you think and your counter-argument why this ought to go up?

PYPL: I have been bearish on PYPL all this while from 226, my target was 198.

AFRM: I became bearish on this stock at 148-151 after poorer than expected retail confidence. My target is 130 bucks on this stock.

Bitcoin: I became bearish on Bitcoin at 64000 earlier in the month. It has been on a downtrend ever since. However, I am now expecting it to bottom out somewhere closer to 51000-55000. Now 56000.

TLRY: this is yet another example of hurt when you ignore the order flow. I have been bearish since 13 bucks, now 10.5. My target on this stock is 8-9 dollars.

I share these names regularly during the week. If you are interested in getting these in your inbox, make sure you subscribe. With a good market like this, I get a lot of tickers like these on a weekly basis. At some point however I have to balance how many names I share versus doing a detailed analysis on why I picked them. I think I am kind of leaning towards the latter. I want to pick one or two names a week and go through a detailed write up on how I found those, detailing out my thought process.

Let me know which one you favor. Want me to share more names.. or get deeper into the analysis side of the equation? I am okay either way, however, it may be more valuable for the reader to understand my thought and selection process.

B) For Tomorrow:

I am going to stick with what’s been working and continue to build on gains in AMZN (now 3700), AAPL (now 158), TSLA (now 1094) and NVDA (now 317) for tomorrow.

Some of these names are extended, however, if broader S&P500 holds tomorrow (holds 3680) , I do not expect them to crater near term.

C) S&P500 Daily Summary :

As promised, let me start off with why I turned bearish a few minutes before the market opened in the morning.

Today’s session is a perfect example why S&P500 is the most mean reverting market there is. It is frustrating to expect straight, linear action in S&P500 on most days. It is a thick market and it favors those who can be nimble and trade in and out. The levels below and turning points are just to appreciate the nature of S&P500 & why you need to move with it! 70% of days are like this. With 3-4 days in a month where you can get trending days on strong volume, if you are lucky.

Per yesterday’s trade plan, my primary expectation was to be bullish above Value Area Low (VAL) 4684. If we fell below 4684 into 4667-4670, my expectation was this level will find dip buyers . 4667 was in fact Low of Day (LOD). Read up on VAL here if you have never before: Basics

My target was 4703 in case this is how we opened for the Chicago cash session. However, this target was met overnight from the time I sent my trade plan at 4686.

Having made that 20 point trip, we opened at 4698. Now while this was above 4684 and 4692, it was not far above enough to warrant a dip buying into the VAL. Was not worth it from a risk to reward perspective.

This is what made me send this tweet at 6:28 AM , a couple of minutes before OPEN: Tic Toc 4697

And when we opened, and shortly fell within yesterday’s value area, this made me post 4697 as the resistance and I was already expecting a break of 4684.

Once 4684 broke, we went straight down to next order flow support at 4670 which got BID up .

To summarize, a lot of opportunities for active traders. But if you had a directional bet , this was not your day. Unfortunately, this has been sort of the theme this whole week, and I do not expect a resolution as long as we balance here between 4670-4710.

Here’s a link to the trade plan dated 11/18: Daily Tic 11/18 in case you missed it.

D) Plan for 11/19/21:

With a lot of mega caps making new highs , I do not expect significant action on the downside as long as we stay above 4680.

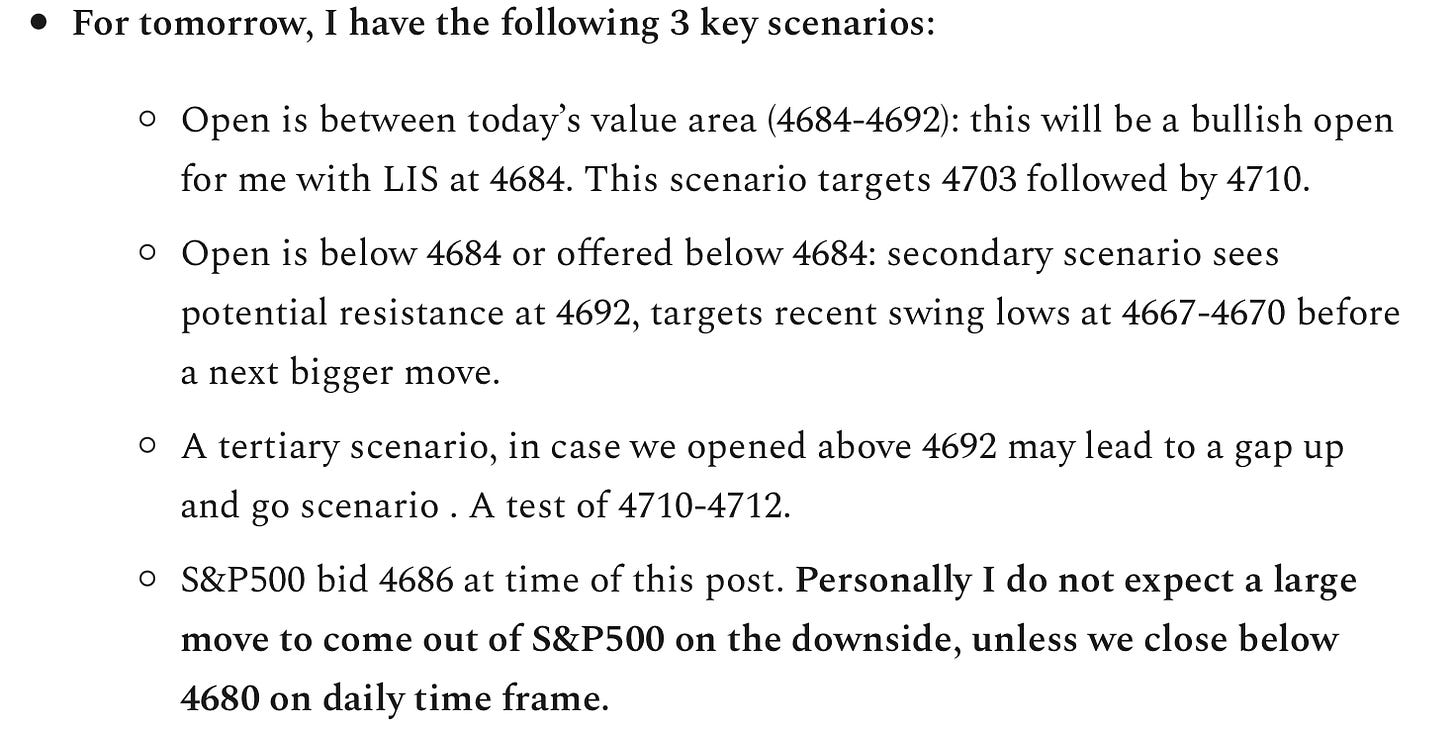

See Figure C for current weekly auction. 4670 is the Value Area Low. Unless we close below 4670-4680, it will be hard for bears to make much headway. With this background, here are my 2 main scenarios:

If we open above 4692, my initial hypothesis will be to trade on the bullish side, unless we fall below 4692. Targets may be 4703-4705.

Bearish case for me will be an open or offers below 4680. This targets recent lows at 4667-4670.

A tertiary scenario is a “gap up and go” scenario on open above 4705. Target 4720-4725.

To summarize, I do not expect major fireworks tomorrow with the mega caps making new highs and heading into the holidays.

I intend to continue using the names and levels that have been working. Dips into 4670 have been supported this week and may continue to offer support , until and unless proven wrong. On the upside, 4710 has been harder and harder for the bulls to break through.

However, as we keep getting tightly wound around 4696 level from last week, there is a vertical move is only a matter of days away, and may come with a daily time frame close above 4710. or below 4680.

That’s it for me for today. Will be back with more. There may not be a weekly plan on Sunday as next week is an abridged session due to the holidays, however, I will be publishing a blog on my scanner settings and what I watch for in stocks as far as patterns go for my subscribers; so make sure you hit subscribe and do not forget to share my blog.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

I would love to see a detailed process of how you pick your stocks verses quantity of stocks picked. Thanks for all your hard work. -Paul

love your analysis, but a lot of us trade at work, so it would be much easier for us if you just sent a tweet that said something like this " looks like we are going down now to 4684 if it breaks then 4670 which i think will hold and get bought up"...instead of this Yet again, inconclusive nightly action. Despite the Asian/German session surge off my 4684.

Now 4697.

If 4684 goes, bears may be favored today.

i know the way you say it gives you some wiggle room when it comes to being right or wrong, but since you get that anyway why not be direct...as you always say you followers are broke dumbies, so we need to be talked to like idiots...thx for all you do....