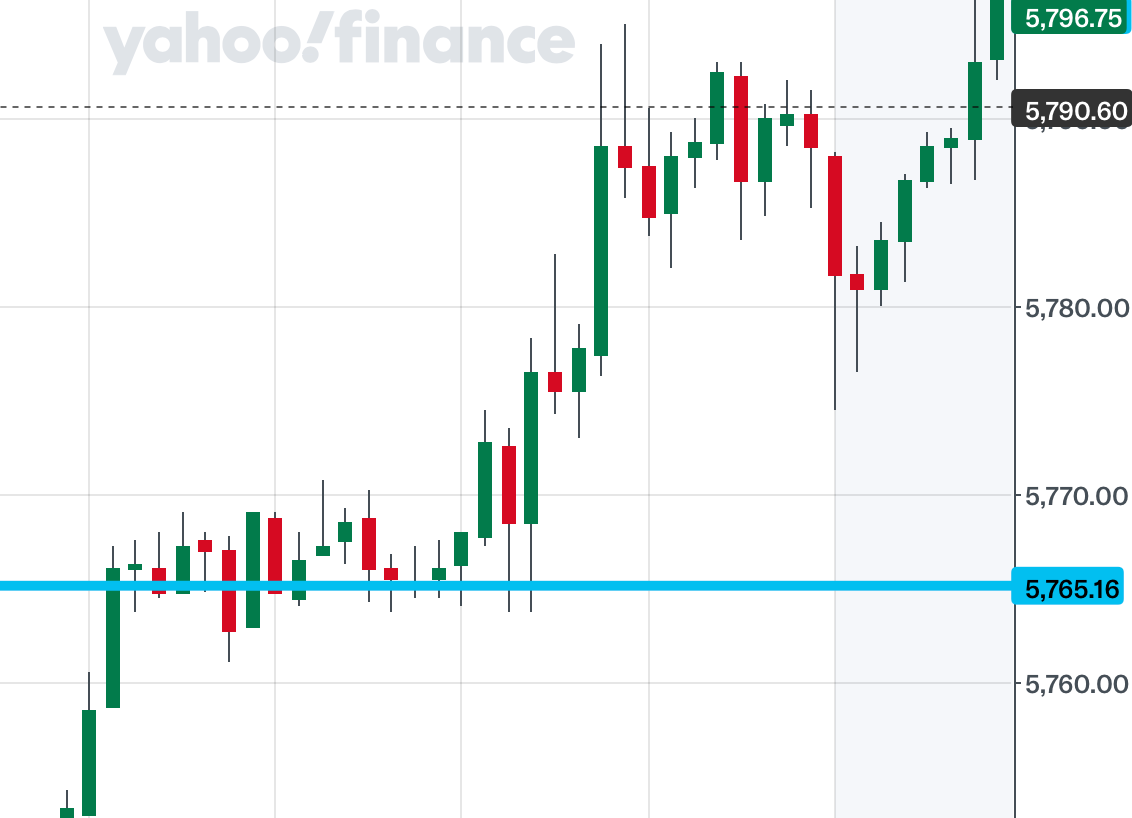

Alright folks, let us leverage that Chart A from the weekend newsletter to see the auction today in context.

The primary context today was to see us float up to 5782 if we opened and remained above 5760.

The market is now open for the cash session. What do we see here?

We see the market not offer an inch below that level. How do we know if the market offered an inch below the level? We will see some candles form below this level, for candle users.

For non candle traders, we will see some sort of volume activity form below the level.

How much activity we see below 5762?

Zero.

Once a level breaks, we can look for balancing below it, or some sort of failure auctions like candles with long tails or pin bars which indicate rejection.

These levels are all shared before cash open, not after the fact. Subscribe now and start getting our OrderFlow levels and educational content almost every day.

Isn’t it better to view the markets in terms of price action and orderflow than randomly predicting what may happen, while ignoring what is happening in real time?

We also saw some pretty massive action today in stocks from the weekly newsletter whether that is CCJ, DJT, SMCI, S, ORCL, MSTR, IBM, ACN, HOOD, NFLX, FOUR, CVNA, NVDA, or PLTR- I can go on. Nearly all of these are big winners. And the best part is that no one really expected them to do any good. Which means they could have some more fuel left. Personally, I am not aware of a service sharing such much ideas, for any price, leave alone for about $1 a day. If you know one, let me know.

Like how many thousands gave up on NVDA at 100. I remained steadfast that this stock has life left and today it crossed 133 again. Yes it took a month, but a 35% move is nothing to scoff at.

One thing I do wanna share as a personal cautionary experience is that you have to turn off all the noise. And by that I mean you have to zero down on the number of folks you interact with, when it comes to these markets.

This is a common refrain from few folks that if we have so many great winners then why don’t we see a lot more folks winning. Well, first off we do not have every one subscribe to the newsletter. On top of that if we have a multitude of who subscribe, there will always be dozen or two who are disgruntled. There is no way to avoid this, this is nature of the beast.

Why are they disgruntled? Look, not everyone is looking at the same things as you and I are, and certainly not everyone is looking at short term weekly or 0DTE. There are 4000+ NYSE stocks with thousands of traders, all active from scalping to investment time frames. There is simply no right and wrong answer in markets, there is so much going on in all sort of time frames and sectors/industries.

For most part, larger traders tend to hold on to for a swing time frame but mostly in several month to year plus time frames. This is why if there is one takeaway then that is to elongate your time frame. Rome wasn’t built in a day yada yada.

Also, just consider deleting all your chat rooms and apps and such. As I said there are always a few disgruntled folks who may be unhappy due to a variety of reasons- may be they got bagged in 0DTE, may be their cat ran away, may be they just have a disgruntled nature. Do you want to import negativity in your life too? Just focus on the markets. Tune out all noise. If you don’t like a furu (internet expert), get a new furu but for most part every one is copying everyone else and very few are paying any attention to things that actually do matter. Don’t take this lightly, this is an important suggestion to improve your execution and enhance focus. Do you think I get my levels and ideas from furus? Do you think my ideas are impressive? You would be more impressed to know that I consider 0 feedback from other furus. Even an expert in a stock such as DJT may not be looking at what I am looking at, his or her time frame may be way off than mine- hence there is no point, other than independent research.

Levels for tomorrow

So with the session tomorrow, the FOMC minutes are the main event risk. S&P500 current 10 day SMA around 5764 remains in focus. We are now about 5790.

Scenario 1: For the bears here, the 5764 level now is sacrosanct. They need few closes here below 5764 else we can see another swipe higher at 5804-5811.

Scenario 2: The edge case scenario will be below 5764 or above 5830 in which case I may send out a chat update for folks during the session. Stay tuned.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.