Hi Traders-

The Substack team has launched a new features that lets the authors create a chat like thread which can be shared with the subscribers. It is a way to send out the updates in a more real time setting than an email.

I had been asking them to implement this feature for a while now and I am glad they have delivered on this. There are a couple of caveats though. The first one being that this is only available to the iPhone users (for now). The second one being that you need the app for this to work (for now).

I was emailing their product people last night and they indicated this will be available for the Android users as well - I think they will release it by November. Eventually my goal is to have all paid subscribers get an access to this tool where I can share my thoughts and opinions in a more real time setting- especially when we have high volatility events like elections, FOMC, NFP etc . If you have not, then consider subscribing below to get access to the threads chat whenever I share something real time. This feature will be exclusively only for the paid subscribers with a few posts available to all every now and then.

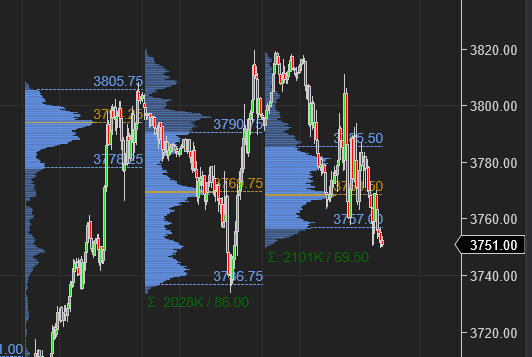

An example of this was today, when I shared this AM that if we opened at or above 3780 , we could test that 3810.

On top of that, I shared that both 3810 and 3760 could be important levels today. Lo and behold, we opened right at 3780 and then we proceeded to trade 3810 within minutes.

Not only was 3810 the session high today, 3760 was also the session low for most part of the day today. Very good levels in my opinion which held the session together until that break late in the day.

Now the action today was not for every one I think.

The day for most part was choppy and it requires a lot of focus to execute on a day like this. This begets the question why do we have days like this? Whenever we have days like the one today, I can not help but ask my self why do we have days like this?

The answer that I feel makes most sense is that the days like today show a lack of Other time frame traders (OTF traders). I personally think for the market to move in a linear and directional manner, we need to have other time frame traders active in the market that can push the market away from value. I feel may be 3 out of 10 days tend to be linear, whereas a large majority of days are like today - which is not a bad thing in itself, it just requires patience, focus and having good levels to lean on.

When you mix short term options with auctions like this, I think the results can get even more frustrating. In options, you not only have the directional aspect in price of the option, but then you also have the time decay component. You combine this with the fact that most of the folks when they look at the option price, they only focus on the price, they may not be paying any attention to the underlying characteristics of these options - like how much will the option price change if the underlying price changed? How fast will the change in price be? Now I do not want this to be a class in the option Greeks but if there is enough interest I can do a separate post on this one of the days. The key advantage of an option for me is the fixed risk (assuming I am buying and not selling one). In futures, I do not deal with the time component. There is no time components and the price action tends to be more raw. The downside on futures is the leverage and the unknown/unlimited risk due to this fact.

The auction tomorrow

Normally on days of the FOMC, NFP and CPI , I do not like to plan super formally as the market can exceed volatility threshold and throw these levels around. I do send out a few things I will be watching and my general bias.

So, now day to day auctions aside, for some weeks now , I have been expecting a range to form between 3650-3950 and while it has been a very volatile last couple of weeks, the bottom end of this range has been supported for most part.

I have also been shy of touching momentum names like TSLA around 300-330 when a majority of folks were chasing it at those highs and TSLA has now come within a whisker of my 180 level which is very important for me personally. This stock has lost about 20% on the week alone - very weak action. However, as we approach my key LIS in both TSLA and AAPL, I think we are approaching a good low in the S&P500 as well.

Going into the session tomorrow, my key levels will be 3720.

With the NFP tomorrow coming out about an hour before the cash session open, I think the bears have their task cut for them to break and open below this 3720 level.

I think as long as 3720 remains supported and not broken by the bears, the pain trade may be to the upside. I will reconsider my bias if we are able to close the session tomorrow below 3720. Until then, I do think we may want to retest what is out there at 3950.

At time of this blog, we last traded around 3750.

I will try and send out an update to this via the threads feature in Substack for the subs. To get access, subscribe below.

A few other names I think look interesting are:

RBLX

I am watching this, if this holds that 36-37, then we may see recent highs around 45-47 on this again IMHO (in my opinion).

VZ

A few months ago I became a VZ bear at around 55 and no one could have imagined this stock could collapse the way it did, so fast. I think it may be because they are saddled with debt + losing customers.

I want to see if the yields top out and with a bid in bonds, I will think that VZ may see some support come in and atleast form a range here near the lows. I think it really comes down to if we can see some firming in bonds which have been losing almost every day.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Tic, it pains me to see idiots attack you on your guidance the next day and your appropriate real-time reactions that they don't understand. I can feel it affects you sometimes and there is not much we can do against jealousy and pettiness.

Any experienced trader knows that all we can produce is a plan, levels and rules, no one knows what will happen tomorrow; all we can do is know how to react to change.

IB high/low, TLT, big tech, USD and other tools help and no one can spoon feed anyone.

Just a note to let you know I appreciate you and I enjoy your writing as much as your content

Take care

My biggest win was not trading on a day like this