Traders-

If you have not yet read my plan from last night, I recommend that you do , to stay abreast of the continuous auction.

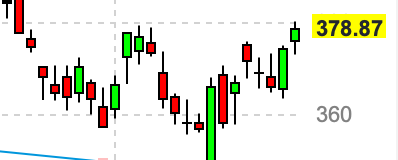

The theme today was an extension of what we have been seeing from last few days. Last month, I was perhaps one of the handful who saw a new range form between 3550-3950 and today we are about a 120-130 points off this range high, having come off about a 300 handles from the lows.

We gapped up Sunday night, came close to the LIS last night but missed it by a few and at the open, I had a bullish tint into the market at 3760-3780, which we saw us float up to about 3825 towards end of the session, to close the day around 3800.

A lot many more of the names shared by me here in the Stack did well today:

UNH today closed in on that 550.

New highs in names like XOM

New highs in names like MRK

New highs in high yield names like the banks (BAC), O etc

AAPL trade up to almost 150 bucks today

Using OrderFlow, I stayed on the right side and not fight this tape.

Personally I do not know of many other publications like this which can share so many names across a diverse range of industries and sectors. This is what makes this one of the largest, if not the biggest Stack. If you have not already, consider subscribing and be part of this journal.

Tomorrow is also SPOT earnings

My LIS on this will be 92 dollars. I think if 92 holds, we could see 100-102 on this. Now 94 dollars.

ENPH

My LIS on ENPH will be 257-258. It is now around 253. I became bullish on this earlier at 180, before it moved to 300+ but now at 258, I will avoid and may consider lower in the 230s.

My levels for tomorrow

My key level will be 3825.

Scenario 1: An IB close below 3825 could target 3790. A break of 3790 then may target 3750.

Scenario 2: An IB close above 3825 may target 3855-3860.

At time of this post, we last traded around 3800.

Personally, we are now about 320 handles above the lows set not a month ago.

With several key earnings tomorrow like MSFT and GOOG , I will be curious to see if we get to trade some of the weekly LIS around 3710-3720 again or not this week.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Great short read...always to the points. Levels perfect today even though I couldn’t trade as much as I wanted too. Will be interesting how the markets react to Apple. Seems they are raising the prices on services. Let’s see what they have to say about China!

Any thoughts on msft and goog?