Hey guys-

So the main expectation from last night’s plan was to see us sell down from the Friday close into 4200, where I expected the dips to be bought.

This was a good call as we sold down overnight almost into 4200 and then saw a rapid rally into almost 4300, stopping shy of about 20 points.

It is here that I sent out a chat update below. As soon as I sent my chat message, we started selling and sold down rapidly about 40 handles. We ended the day at 4250.

I also had a good call on TSLA with support coming in near that 200 to test 215 shortly thereafter.

My levels for tomorrow

4230.

Scenario 1: As long as we do not see an intraday close below 4230, I think we can retest 4275.

Scenario 2: If we see an intraday close below 4230, we may be able to retest 4200.

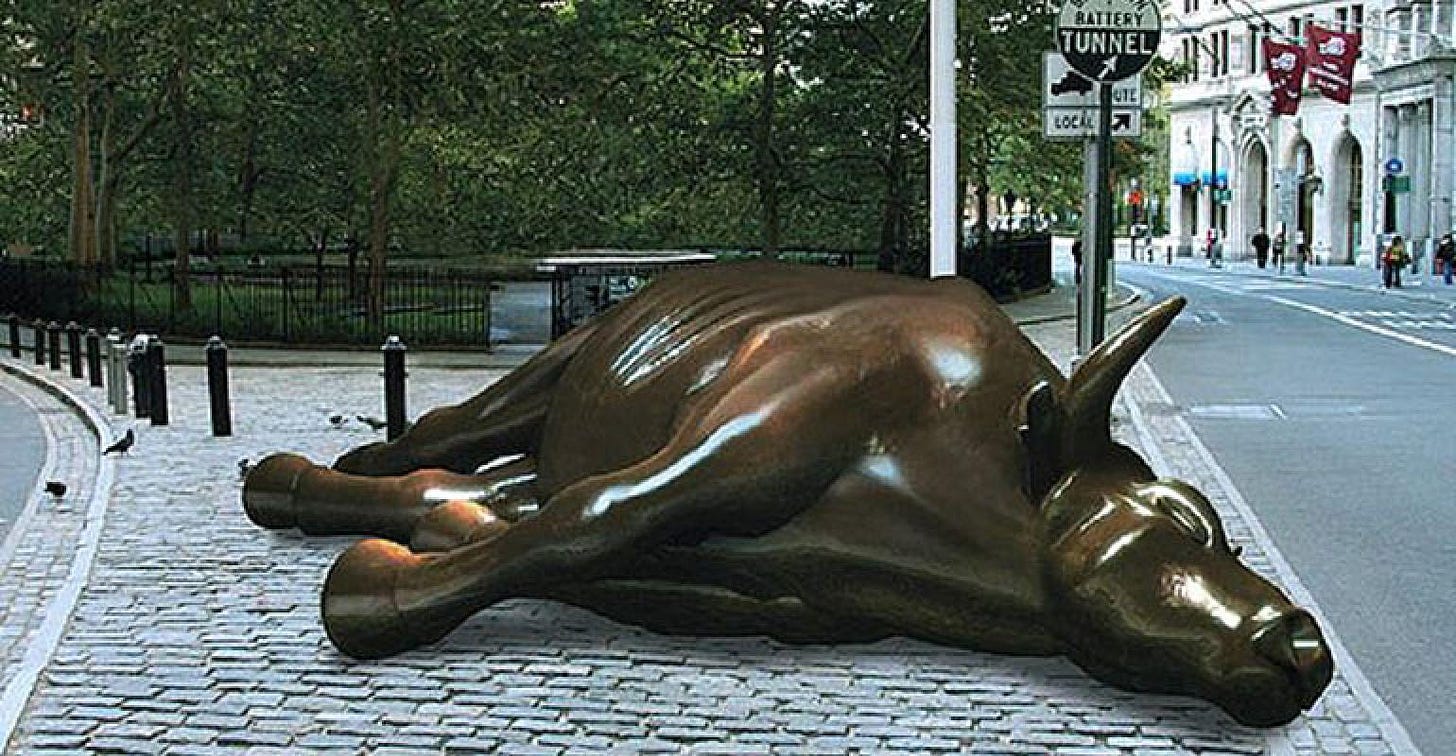

At time of this post, we last traded 4250. Overall, not much change from my weekly level view. I think the bears need to take out 4200 for a much deeper sell off else we could remain range bound here.

MRNA

With Moderna, I had a long term bearish call for a test of 65 dollars near when it was 500. It has since traded down to 78 dollars. This will conclude my call on MRNA as I personally do not see much reason to be bearish on this below 60-65.

MARA

I like the action in technicals in stocks like MARA in crypto space.

It is around 8 dollars right now but I think if 8 holds, we could test 11-12 on it in next few months.

Outside of day to day levels, there is a tremendous level of bearishness - not without merit. However, the main risk for bearish is 2 fold. A) just the technicals. We are holding 4200 and it is an important level to hold for bears’ comfort. B) the earnings this week and the next are true wildcards. Names like AAPL are still holding 170. There is a risk to how these earnings, even if they are a miss, will be perceived. AAPL right now is carrying a sense of flight to safety and unless the earnings are truly horrendous, I am afraid they may be perceived as “priced in” for this quarter.

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.