Traders-

We wrapped up last week in a pretty good shape for the bulls. Atleast those who have been bullish from the 4130-4200 area last few weeks. The backdrop of this strong finish to the upside is a belief in the market that the FED is done hiking and that the inflation will rapidly fall in next few months.

I agree with both of these assessments- I think we will see a rapid deflation in most categories. For example, used and new car prices, rent, imported goods as indicated by several import price metrics. I believe insurance prices which represent about a 3% weighting in the US CPI will also come down quite a bit next year helping folks get relief.

The part I am not convinced will follow suit is the energy prices as well as some costs associated with healthcare, as well as food prices. At any rate, this FED calculation has convinced the market that the worst is behind us, that the FED is done and has even achieved the impossible- bringing inflation back down to 2% next year, with unemployment rate still relatively low below 4% and economic growth still strong. The perfect Goldilocks scenario.

On my part, I have been warning almost on a daily basis from last 3 weeks or so why I can not be a short term bear so close to that 4130 level.

The results in hindsight are always 20:20 as we see now culminating in a brutal November day for bears who got taken to the woodshed on a Friday! The sentiment also remained dismal. On the sentiment side, I tend to have a good pulse on how folks are feeling as I interact with a wide range of folks both off and online. This was one of the most negative sentiments I have seen in last year and a half and I am not surprised by the outcome.

Will the bears continue to take a beating next week? Will the bulls see their new found fortunes dwindle away?

Stay with me as I attempt to answer these questions based on my own technical analysis.

However, before I go there, let me share my thoughts on the housing sector. This is one of the biggest sectors in the US and employs hundreds of thousands of people and supports millions of families. Most Americans also tend to have most of their net worth in the housing sector in form of equity.

I want to thank every one who has shared my newsletter as it is helpful to spread the message of the tape. This is a word of mouth supported publication and I look forward to add some value every day. Please consider sharing, liking and subscribing. Feel free to drop me a line to let me know what else you will like to see shared and improved.

Back to my housing note…

The question I want to answer is that is the housing market a bubble or is it fairly priced?

Folks will remember back in 2022, I was a bull in the home manufacturers using XHB 0.00%↑ as a proxy ETF for the sector. It was trading around 55 and no one wanted to touch it citing high interest rates and lack of demand. A year or so fast forward, it rallied up to 85 bucks and has now been trading near 80 now.

The argument I used for my bullish bias was that there is simply not enough supply for the home makers to be selling at 55. This was a good argument as the supply then shrank even more to multi decade lows and is fairly low even now in 2023.

So, can the home prices rise from here?

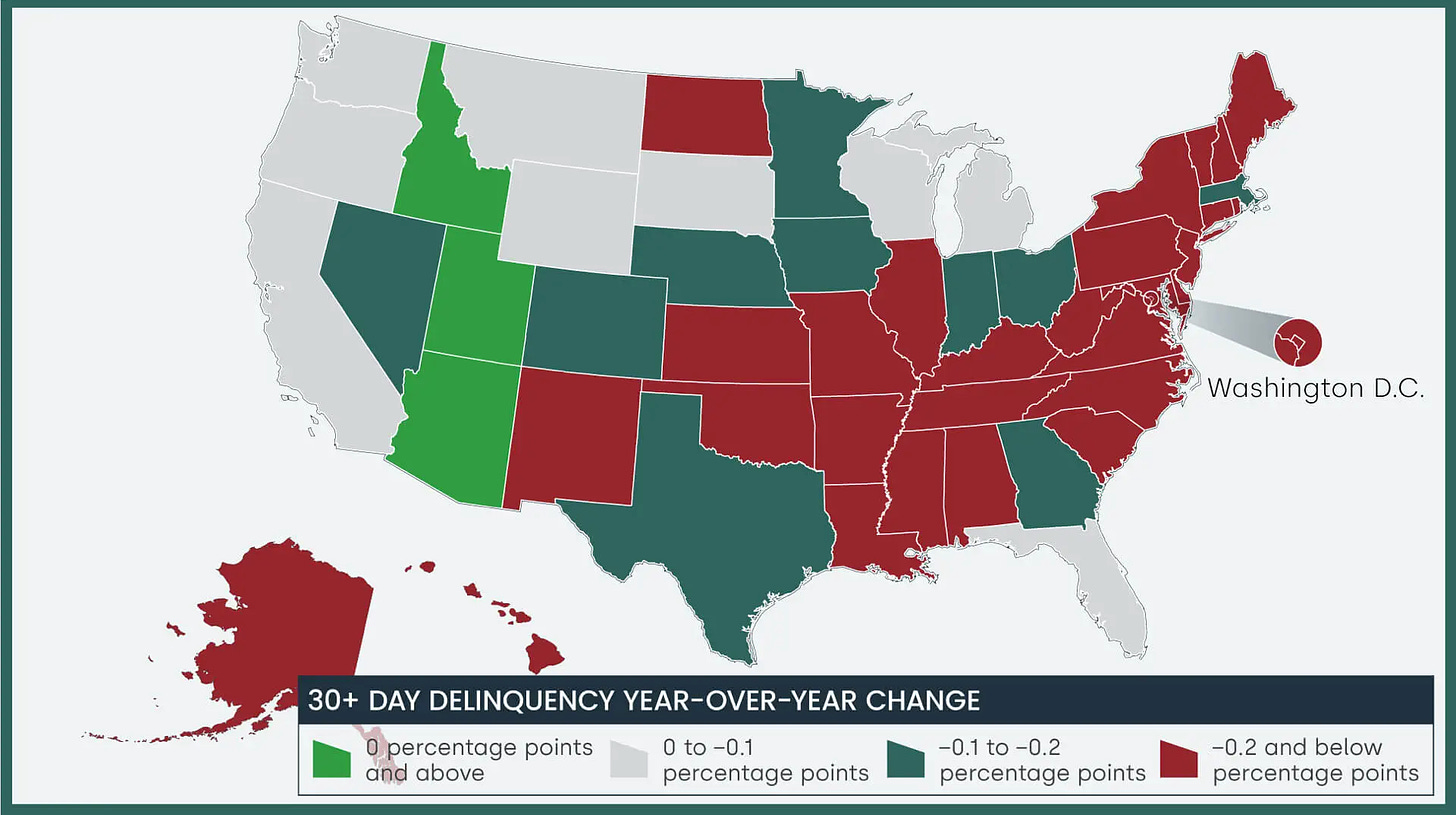

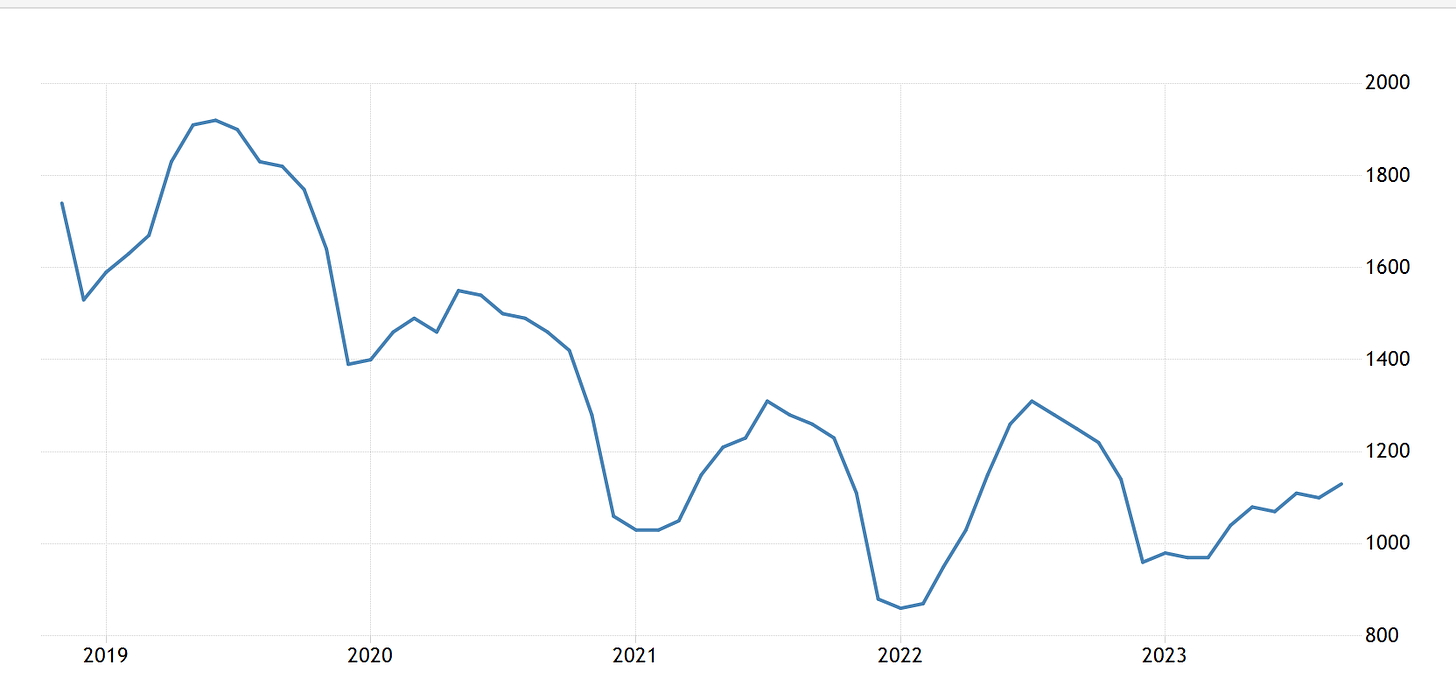

From Figure A you can see after that initial swoon in 2022, the home prices are about to make a new high again in 2023. This is despite the 8% mortgage rates.

Hosing inventory

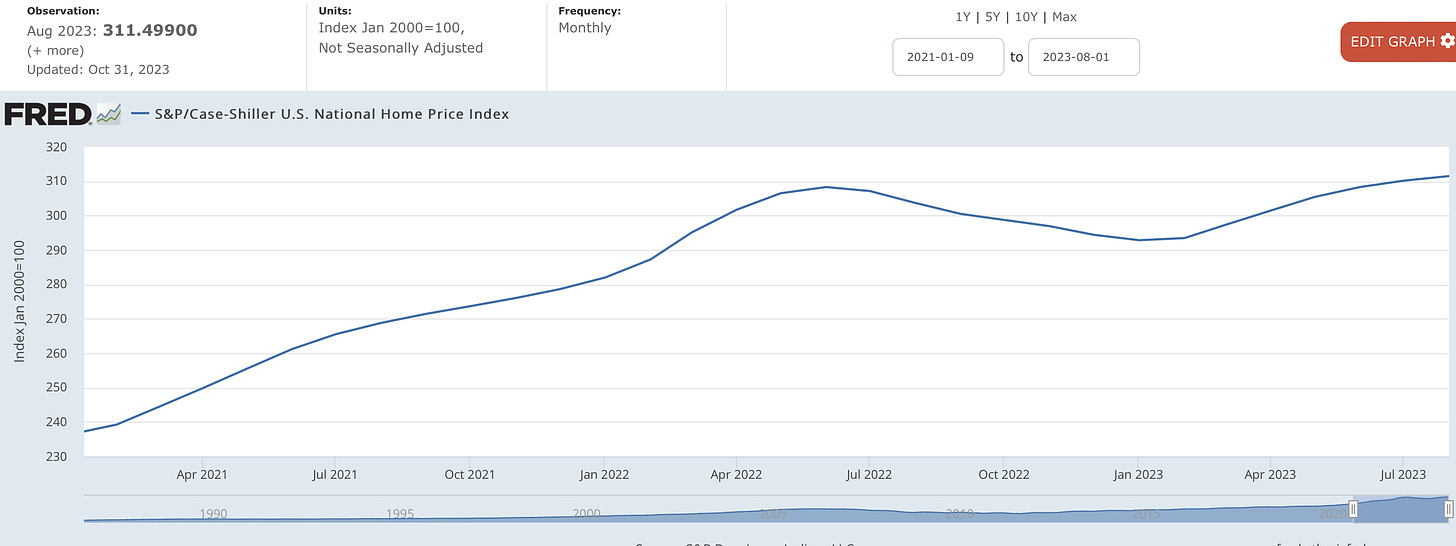

Figure B below from TradingEconomics/National Realtors Association shows inventory is rising but it is still far far below the longer term averages.

So, if you put Figure A and Figure B together, the natural deduction from this is that the home prices will go higher in near future.

However, if that is indeed the case indeed why are we seeing price reductions in most cities, in particular some areas like Austin seeing a 11% YOY decline in home values.

A possible answer could be that those markets had seen a higher number of folks moving in from California which drove up the prices by a lot in cities like Austin, Phoenix, Miami and Southlake, TX. Now some of that fluff is coming out in 2023.

Figure A above is legit. It is real data and you can’t argue with it.

Figure B above, I think is an artificially low supply for a major reason. Some of these markets like Austin have seen too much speculation in the housing sector at the moment with very well qualified borrowers owning multiple properties at sub 3% interest rates. By some metrics, the percentage of homes sitting vacant has been the highest ever. This inventory is in state of a “potential supply” but has not yet hit the market but soon it will due to below reasons-

A) As unemployment rates rises, some of the 2-3% rate mortgage borrowers will be forced to sell.

B) While your monthly mortgage at 3% is fixed, the insurance costs are rising steadily. In some metro areas like Ft Lauderdale for instance, average insurance cost can be 4000-5000 dollars a year with extremely high property tax rates which sit at 1-2%. While your mortgage cost in form of interest is fixed, you can not control the cost of maintaining your home which is steadily rising in most markets.

As more supply hits the market, the values of existing homes in neighborhoods will also drop, whether you want to sell or not, as home values are based on a weird concept of “recent comps”.

Now the key assumption for this to go down this way is that unemployment rate to rise to about 4-5%. Now lets say the unemployment rate stays steady below 4%, inflation cools down to below 2%, then all of us homeowners live happily ever after in paradise because we are not forced to sell our once in a lifetime lotto of a 2-3% mortgage for 30 year loan.

However, I think that is fantasy land.

Old habits die hard and the FED will balloon its balance sheet again at some point. I do not know when that is- next year or 2 years from now. However, at the moment, Quantitative Tightening (QT) is a real thing, it exists and the balance sheet is deflating, the rates are still high and in the short term, could be higher.

This in turn means the mortgage rates could still rise higher. Now on paper, when mortgage rates are 7-10% and you have your 30 year fixed at 2%, you look like an extreme, rare form of genius. However, in reality, it has an ugly downside too.

At 10% mortgage rates, the demand for home loans can dry up. This will mean that the home prices will have to come down, else no one will be able to buy one.

Due to these factors, even though the official data seems to point to higher home prices and lower supply in near term, I actually think we can see lower home prices and higher supply in next 1-2 year time frame.

I expect about a 20% cut in home prices which now sits around $430 K nationally in the US, but you can extend this logic to most Western countries like Canada.

This means we could see national average home prices bottom around 350K/370K and this is where I am a buyer, if I am interested in real estate. Now in longer term scheme of things, if you just had a set of twins and you do not want to see them grow up in an apartment with walls shared with a bunch of Zoomer neighbors who vape all night, you do not mind paying that extra 80K which hopefully will even out in next 10 years.

My point being that the home ownership is a very subjective decision. It is not always a rational decision, like if you want to live in a certain school district, you pay up. You want to live next to a Starbucks, you pay up. Those are outliers. I am interested in the averages and I think the averages are headed down.

I do think there is going to be a natural support for this market if it were to sell down another 20-25% versus some who believe an outright crash of 80% is coming next. The reason being- the FED will bail out the system again as old habits die hard, and recent old habits die harder.

My levels for next week

Let us zoom back to the S&P500 levels. I am using Emini December contract for the the levels, for the $SPX levels, simply subtract about 15 from these.

From an event perspective, the CPI planned for next Tuesday, and the PPI on Wednesday is going to be extremely important in the US session. There is also the Chinese industrial production numbers that will be released later in the day on Tuesday which I think should be an important Econ metric.

From a related market perspective, I think the Dollar index is going to be important. While Friday saw a solid rally in the US indices, the Dollar was also relatively well bid.

On top of this, we saw softer than usual US treasury auctions which put some pressure on the longer dated yields.

In view of these related markets, I am of the opinion that any uptick for inflation on Tuesday and then the PPI on Wednesday could lead to a well bid environment for the US dollar.

I think there is going to be a divergence between the CPI and PPI. CPI could well come in hotter but then I will be very surprised if the PPI also comes hotter on its heels. Typically, PPI can lead the CPI by several months and I do not see a reason for the PPI to uptick given the recent slowdown.

As such my key level next week will remain 4450/4500. On Friday, we ended the week for emini near 4430.

Scenario 1: Unless the bulls are able to close above 4500, in my personal opinion this could be a resistance for a move back to 4350 area on short to mid term time frame basis.

Scenario 2: 4350 could be supported for a move back to 4430, however, if the bears are able to get a close going below 4350, this could be a major coup and I think an impulse move could target 4230.

I am expecting decent fight between the bears and bulls here around 4450-4500. I will be surprised if we are able to take this 4450 out on Monday with relative ease, as I will think this could be tricky for the bulls, one day ahead of the CPI data on Tuesday.

To summarize: I think this whole 4450-4500 zone will be a hard fought zone here for the bulls. Unless overcome, these rallies into 4450-4500 may be sold for a test of 4300-4350 which is next super important zone. Mega caps are bulls’ allies and look good. At the same time, if I am a bull, the action in Dollar, which is creeping back near 106, is keeping me up at night.

Slightly longer term, a lot of folks have very strong and cogent bearish arguments- the bears have extremely well thought out talking points, which I happen to agree with in its entirety. I share the same views too, with an important exception- I also happen to read the tape every day.

From my perspective, I just need to qualify my bearish bias with something more tangible- price levels. This is why I can not be too bearish at 4100 as technically that is an important level. That same way, I can see this 4450-4500 zone as important. Yes, I agree and align with most all bearish arguments which make perfect sense to me. However, if we are now closing above 4500 on a consistent daily basis, to me that signals a little bit more pain on the upside ahead. You can think of it this way- the bears have logic on their side and the bulls have the money on their side, atleast in the short term. If this was not the case then we will be trading way below 4000, 3900 already, rather than be here so close to 4500. This is why I give so much weight to these levels. Regardless of how I feel about the macro, if the macro is not supported by the order flow or tape, the macro side is going to take some heat. And that is exactly what we are seeing at the moment. The bears need tangible wins, not just logical arguments. They need to capture territory or in other words key levels from the bulls.

Some other things on my radar

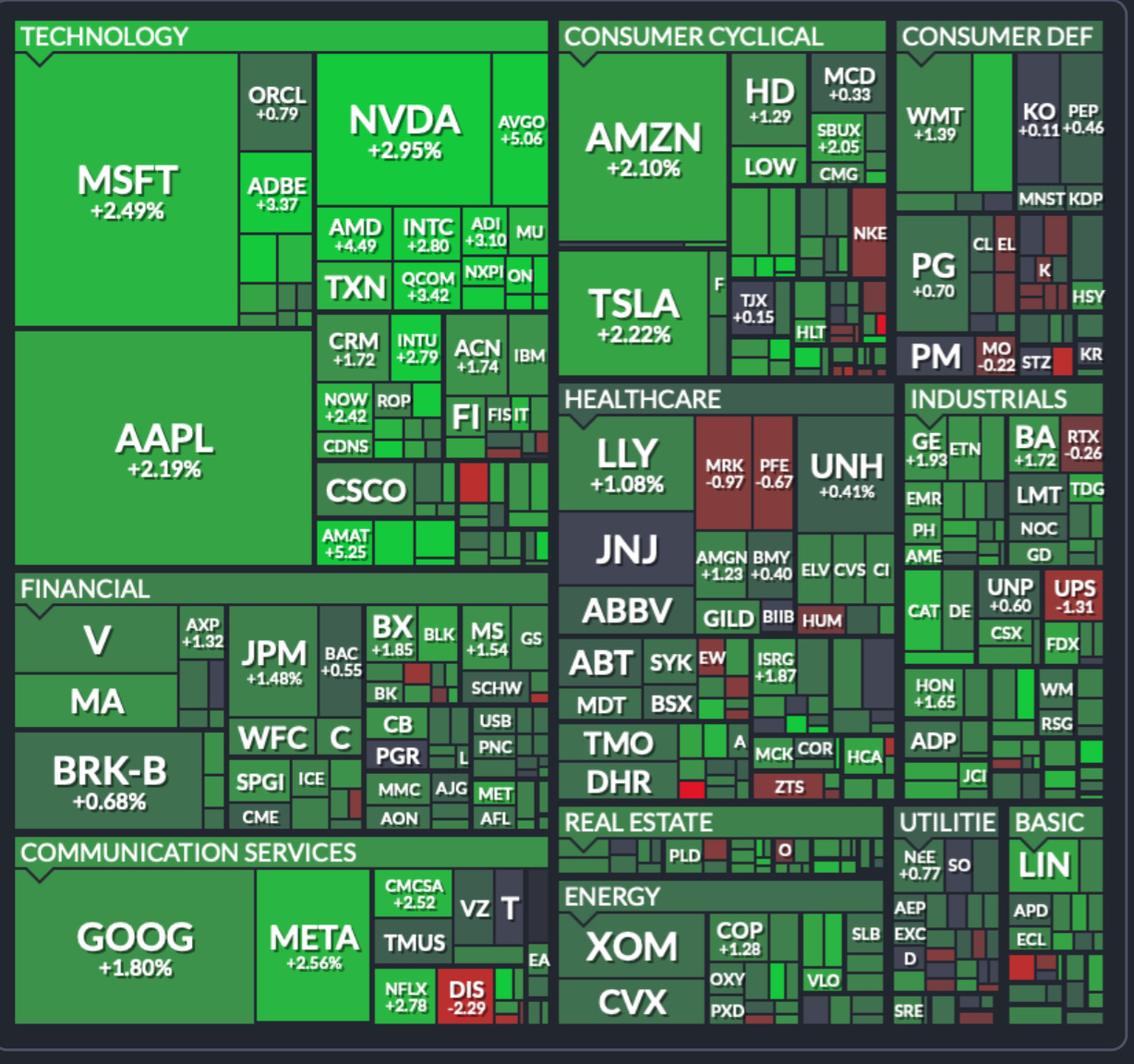

MSFT

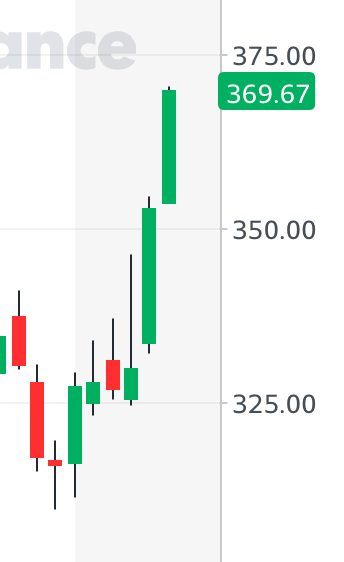

With respect to MSFT, I was a bull on this around 300-330 level and shared this level with folks here in the Stack.

It had an excellent week and managed to almost clear 370 on Friday.

Looking ahead, I think if the general market is not able to hold 4450, we could see a pullback in MSFT into 350s.

Mega caps like MSFT, META, GOOG, AMD, NVDA, all of which I have been bullish on recently, have fueled this rally.

This action has created an extremely important level right below us at 4300-4350. I will go a step further and say if we begin to see Weekly level closes in the emini below 4300, I would think that is not a great news for these mega caps. In that sense, 4300 is my new 4200 and as such a massively important level, headed into next 2-3 weeks.

Let me put it this way- all of these mega caps look super interesting right now and I think if they were to break out of here, that is likely to fuel a (much) larger rally in the general index like NASDAQ and S&P500. Just look at the mega cap longer term auctions! They all look super interesting.

However, the flip side of this is if we start slipping below 4300 on the main index itself in next few days, then I think we have seen a decent high put in here at these levels. Though I think the auctions in most of these mega caps look robust, what is raining on their parade is the suspect looking action in the US dollar as well as the swoon in the small caps. For instance, look at VXF 0.00%↑ that was unable to clear its prior weekly high, even though QQQ and SPY made new highs.

GOLD

I am liking the action in GOLD 0.00%↑ here around 15 dollar.

Some of the longer dated options in GOLD are quite cheap in my opinion for instance if you look at the $17 call for June next year, it is offered for around 90 cents at the moment.

While 8 months is a long time, I still think the IV on this is still extremely low, given everything else that is going on and this is one of the reasons why I personally think this option is cheap. Now with Gold, if we get a hair cut next week due to a stronger dollar, again my view remains that Gold is in a longer term bull market and could see some support if dips near that 1900 level. If we begin to see Gold clear 2000, with overall volatility in the market increasing as we head into 2024, I do believe a repricing event for some of these options could occur.

Look, the US market view is very narrow at the moment. It is all about the FED and the rates in short term. This is reflected in $VIX which is like 14 right now. It is completely ridiculous! However, this is not very surprising to me. A lot of these traders and funds are based on algos, and the guys who wrote these algos probably were not even around in 2008, let alone 2000. So they view this market in 1-2 dimensions, a very narrow view. However, there is a lot going on in the world right now which I think is not being reflected fully in the price of S&P500. If this was not the case, we will atleast see some level of fear in the market in form of VIX above 20. A VIX at 14 on this day in November to me atleast just screams complacency. I am not sure if this much complacency is a good thing.

MARA

Unlike Gold, the volatility in some of these crypto stocks is already extremely high.

I have been bullish on MARA from 3 dollar area and it is now around 10. I think any dips on this into 9 could be supported for a move higher above 11. Since the volatility is quite heavy, some of the options, even looking at the January MOPEX, they are offering 10 strike calls at around $1.5. As long as 9 holds on MARA, I think these calls look decent. Now note that with the debt drama next week in the Congress, it could be a volatile week for these crypto stocks which are very sensitive to a constant IV drip of fiscal and monetary stimulation. This could put a dent in these option prices but may be supported around $1.

Folks, I share my personal views and thoughts on a variety of topics- whether that is the futures, commodities, forex, S&P500 or Options, almost on a daily basis. If you find this newsletter helpful and would like to see a copy of your own in your inbox almost every day, consider subscribing and sharing the publication. Chat room is included for all subscribers.

It is a wrap for now. Have a great week ahead!

~ Toc

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Yahoo, Google. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.