Good Morning Folks-

In markets, there are millions of participants. There are even larger number of strategies employed. You have hundreds and thousands of experts proclaiming they can predict what is coming next in the hottest stocks. This is all done to eke out a gain out of the markets.

To find an opportunity where you can either buy low and sell higher, or sell high and then buy it back cheaper.

While the internet experts or the so called “Furus” will convince you this process is simple and the holy grail can be found on a 5 minute chart, this is not such an easy task as the Furus make it out to be. The current price of any stock or futures or an option, holds all the information about the asset in its price. And that is what makes any sort of analysis so hard. Options make it extra spicy with time decay.

So everything and anything that can be known about something, is reflected in something’s current price. The market system is very efficient in assigning this price.

So to make money in this kind of extreme efficiency where all the known facts converge in current price, you have to have some system, some type of methodology that can give you an edge. This is not as easy as becoming very good at reading indicators like RSI and MACD.

An indicator like RSI is cherry on the cake, but not the cake itself. The cake is gaining insights into a stock that is about to move, BEFORE such insights are gained by other participants, so you can get in earlier than other participants. In an efficient market, as soon as the new facts emerge about a stock, these are absorbed almost instantaneously in its price.

Why do I share this? To reiterate what it takes. So we remain focussed and are not distracted by the snake oil salesmen selling you some fancy indicator with 90% accuracy, if only you paid them $3999 for a 3 day course, then you could also make millions every month.

This is going to be a slightly abridged post. As we get into the Summer months, the velocity and momentum of the market slows down. There are not many great set ups, as there are early in the year and in Fall months. But this should NOT stop us from looking at some interesting things on my radar, starting with Banco.

BMA

Banco was first shared here in the Substack a few weeks ago at around 45 dollars. It is now pushing past 62.

These stocks are not only benefiting from changes in political regimes to more business friendly regimes, but they are also seeing a renewed interest from the Wall Street.

Wall Street is betting big on South America with the development of Carbon Markets.

What is a Carbon Market and do we need to know what it is to know what BMA will do next?

First off, no I do not think we need to know what a Carbon Market is to trade BMA.

But it helps to know to know what it is to understand the longer term dynamics at play for the whole region in general and its implications.

So what is a Carbon Market?

Carbon Market’s early concepts date back to 1970s when America launched Clear Air Act. This morphed into cap and trade which the US put in place in early 1990s. The Western world loved this idea so much that it was adopted as a worldwide goal and standard in 1997 at the Kyoto protocol.

In such a scheme, in layman terms, a Central organization or an agency like the EU, puts a cap on how much you can pollute or in other words how much CO2 you can emit. All activities by nature emit CO2- travel by air, going for a run, reading this Substack, all of these activities are CO2 emitters. So EU tells a carbon emitter which could be a coal fired power plant or an airline, that you can emit no more than 100 tons of CO2 a year for instance.

Now if the coal plant emits 100 tons exactly of CO2, then it is all good. But if it goes above that, then it has to buy what is called Carbon Credits to be able to emit more CO2. If it emits less, then it can sell Carbon Credits. This is what is called “Cap and Trade”. 1 ton of CO2 equals one carbon credit.

Carbon Offset, Carbon Neutral and Carbon Credits are one and the same thing. Now when Tim Cook says Apple is “Carbon Neutral” on its iPhones, it does not mean Apple has stopped polluting the environment when it makes those millions of iPhones a month.

It simply means Tim has bought an equivalent number of Carbon Credits to net its emissions to 0. So if it adds 1 million tons of CO2 in the air, AAPL has also purchased 1 million Carbon Credits, hence making it “Carbon Neutral”. This makes AAPL look very environmentally friendly for repeat iPhone buyers, without Tim having to ever plant a single tree in his backyard.

The main idea behind this scheme is that the scheme will make polluting more expensive as over time the price of these carbon credits rises. The polluters will then have to work harder to pollute and in theory develop technologies which lessen emissions.

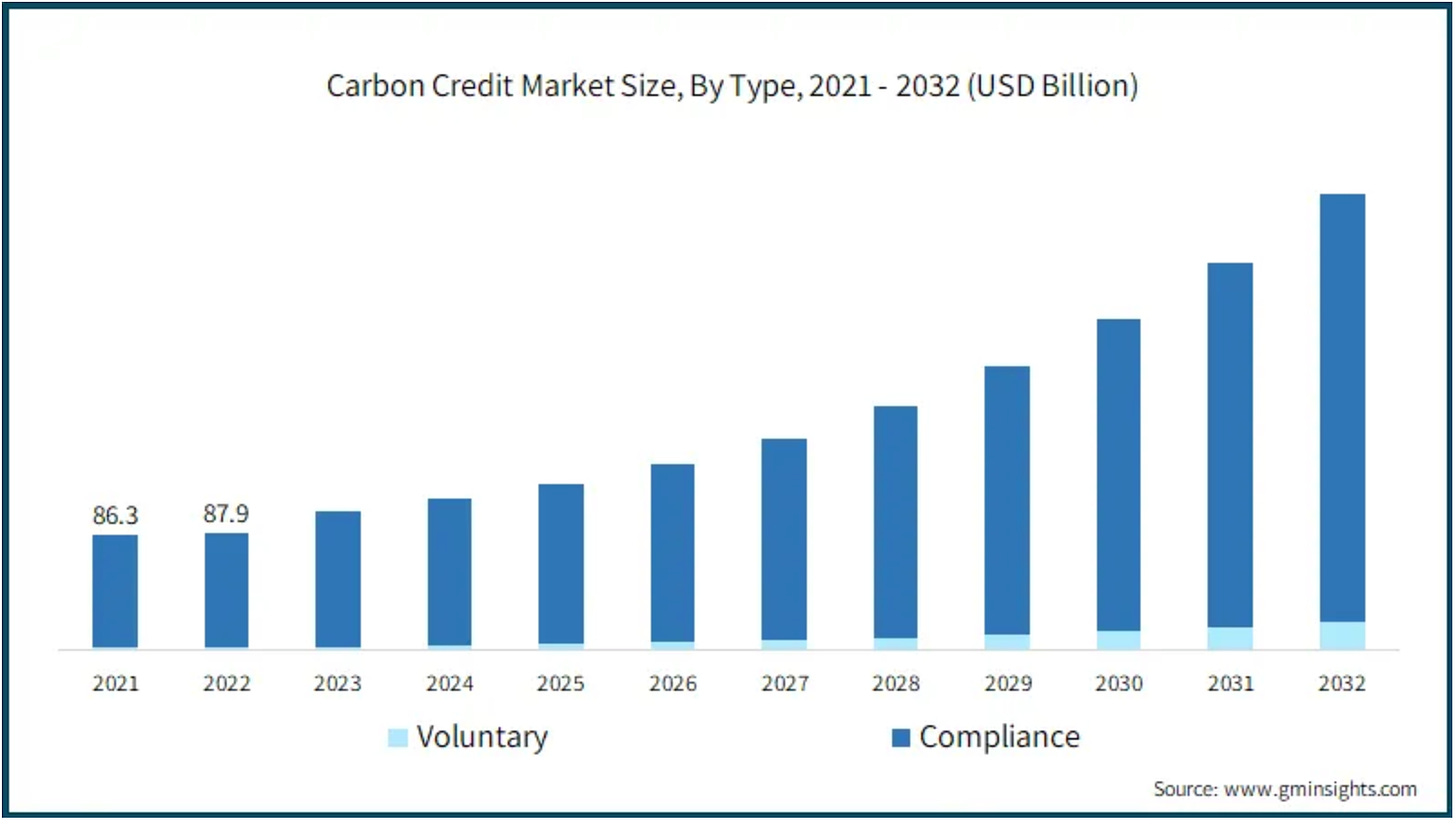

The carbon credit market is expected to triple in next few years. Historically, major polluters like the airlines and gasoline powered automotive makers have been major buyers of these credits. On the seller end, the carbon credit is supposed to offset the emissions like may be by planting more trees, prevent deforestation or making vehicles that do not use the gasoline or diesel. So for instance, since Tesla makes EVs that do not emit any CO2, it earns carbon credits that it can sell to other automakers that do not make as many EVs. In fact, Chrysler bought almost all of Tesla’s carbon credits, leading to almost 2 dollars in profit for TESLA last year solely from selling these credits to ICE car makers. Before TSLA was ever profitable selling cars, almost the entirety of its profits came from this carbon trading scheme.

These profits will eventually dry out for TSLA as other car makers transition to EV cars. Now how much Carbon Tesla emits when it procures those massive 3 ton batteries for its EVs is beyond the scope of this post.

Long story short, the Carbon trading market could grow rapidly. Even countries such as China and India which have been historically against any sort of emission caps have now decided to be carbon net neutral under Global pressure, and have been developing Carbon Markets where Carbon Credits can be bought and sold.

So sensing this new trillion dollar market, in last year or so, the Wall Street banks have gone all in on this trade. What they have now is an ally in pro business leaders like Modi from India, Javier Milei from Argentina or a Nayib Bukele from El Salvador. So these banks are scooping up all the available “Carbon” in these countries which is to say they are stockpiling on the natural land and forest resources of these countries.

So now you have the Big US banks own carbon or trees in these countries to sell them at a later date for Carbon Credit trading when carbon credit prices rise with time. What can possibly go wrong?

In short term, this should in theory be great for banks like BMA. I took a little detour to explain the underlying forces acting on these type of stocks and why I think that a BMA at 60 is still attractive and may head higher towards 90-100+. This is also to show that many of my ideas and themes are not based on technical analysis alone but there are other factors at play as well. This is to also show there is a world outside of NVDA, and SMCI.

As the price the companies pay when they pollute more than the cap they are allowed rises, Carbon market should become more lucrative and grow. For instance in the EU, it now costs you 100 Euros to pollute per ton over your allotted capped quota. I think this is going to make forest and agricultural real estate shoot up in price in most developing countries.

Obviously not everyone can go and buy a forest in Argentina now. Other ways to engage in Carbon Offset scheme is an ETF like KRBN 0.00%↑ (KraneShares Global Carbon Strategy) ETF. KRBN is about $33 right now.

Then long term readers know I have had a bullish view on INDA ETF. I gave this at 10 bucks and then reiterated this at 20 and then 40. It is now trading 50 dollars. I think 35 is a long term support on INDA 0.00%↑ . Within INDA, I like to avoid a lot of IT outsourcing companies but there is still some value in large industrials like RELIANCE.

Now the question is does all this “cap and trade” actually works to reduce CO2 in the atmosphere? May be. I am all for planting more trees and preserving more forests but once you get big Wall Street banks and Steve Mnuchin plough billions in developing countries and their natural resources, it can only mean one thing- higher inflation in these countries, more inequality in society and an eventual credit default. This is the 3rd major wave of Imperialism, disguised this time as a Carbon Offsetting forest.

The underlying idea is noble, but is has been hijacked by Wall Street which can mean more profiteering and exploitation and lesser environmental quality.

What do you think? If you think alike then Subscribe, share and spread the word as it helps this publication. It is supported by readers, like yourself.

PRMW

Primo Water owns and operates 14 national and regional level water brands that engage in water filtration, bottling and delivery operations.

Stock is up 50% on the year already. Normally I am not a huge fan of these super small to mid caps, but combing thru their earnings transcripts, I found an interesting tidbit.

They have a Glass bottle delivery subsidiary which saw a 57% YOY growth! While this may not seem important at first glance, you have to understand that this segment alone could power more growth for this company.

If you have been a long term reader, you know my views on plastics and that includes plastic bottles. I am a big proponent of replacing plastic bottles with glass or steel. However, that is not cost effective. But higher end consumers will pay for such a product if it existed. Primo has expanded its capabilities to produce glass bottles.

Making glass bottles is not easy (compared to plastic ones), but the company can charge a premium for such bottles ($40 for a 2 dozen supply of glass bottles versus $2.99 for plastic Ozarka ones bought at Costco that deliver water as well as some micro-plastics in your body).

Due to these reasons and for strong revenue growth due to both expanding volume sales as well as higher pricing power, I still like PRMW despite a 50% run up this year.

I think if it held 18-20, it could push higher into 30 dollars. It is about 20 now.

The counter argument could be that at end of the day this is a water bottle delivery company selling at a 40 PE. To this I will say the Water Delivery model in glass bottles is what is justifying this high multiple. I think this segment has demand and can drive growth. I am not going with a super high crazy target on this, I think a 30 dollar or so may not be out of realm and at 20, I think the stock is closer to a longer term support of 15 bucks.

BABA

BABA is a tremendous bottom call that I made when the stock was at 69 dollars.

The stock has now cleared 80 bucks at time of this post and is now set to announce its earnings on the 14th (BMO).

Personally, I think you do not have a lot of bears around 70 on BABA. Atleast not the institutional ones.

Now it is no secret that Chinese economy has plunged into darkness, in particular its real estate sector. You also have a larger than life role played by the State in its private corporations.

A lot of these could have been priced in. Even if the earnings come in bad, I think these could have been priced in. The other plus for BABA is that Xi has been on and about, in Europe and elsewhere, trying to jumpstart the economy. This is a plus. Whether it works or not, this is a plus in short term.

Now, this does not mean BABA is free and clear of all danger. I think the biggest danger to BABA is the old bulls around 90-105 area. These bulls have now been underwater for such a long-long time that if this stock retraced to these levels, they may want to get out and break even.

So broadly, as far as I am concerned, I like to see 2 outcomes in BABA on 14th:

I think this stock could have more juice to squeeze on earnings and may trade 90. However, as I said before, there may be some selling at 90 by erstwhile bag holders and if this stocks dips into 80-83 on this selling, it could be supported.

Now if this stock clears 100-105 on earnings, I think this neutralizes the threat of bag holders selling. Now at 105, they are in profit on their underwater longs and this will deter them from selling. In this instance, I see BABA rise to 130+. It is 80 now.

ARM

With ARM, I like this June 21, 125 C which is right now bid at around $2.8.

I think if the stock remains unchanged (it is 108 at the moment) or if its sells off towards 100 dollar, by mid week this week, the time decay could kick in and this CALL could reduce in value. I think if this CALL were to trade lower into 2-2.1 zone, from risk to reward it becomes even more attractive in my opinion (IMO).

GOOG

As the whole AI spiel begins settling down, winners and losers will become more evident in this game.

Google, since it has access to everything you do, from navigation to YouTube to Search to music to email, they are in a strong position to sell you subscriptions to their Gemini platform. I have tried their AI on the Android platform, and while I was not very impressed, I think these features will be refined and soon could become indispensable for productivity.

Due to these reasons, I think if GOOG were to fill the gap near 158-160, I like it for a move back into 180. It is 170 at the moment.

KLG

Let us mix some AI with Corn flakes. Kellogg makes an assortment of highly processed but cheap “foods”.

While I do not recommend you eat their products, I do think that this is a recessionary stock. I think their sales will grow in next 1-2 years as folks get sticker shock from higher fast food prices. A lot of Zen Z and students anyways have Corn Pops on their menu every night along with Ramen.

Corn Pops maker is a recent spun off from the parent company and has seen strong insider buying. It is now trading around 21 bucks but I think the stock is in an uptrend, and I think this is headed higher to 36-40 area as long as 10 holds.

Levels for next week

Next week is a fairly heavy event risk week. Powell will speak on Tuesday and we will also have the Producer Prices on Tuesday.

This will be followed by Consumer Prices on Wednesday. Recently, we had 10 and 30 year bond auctions which showed pretty good interest by buyers of these debt instruments, highlighting that the investors are comfortable buying at current yields, expecting the interest rate pressures to ease.

I agree with this sentiment. I am predicting the headline inflation to come in at a 0.4% on Wednesday, a third consecutive month of 0.4% as well as the core to come in at 0.3%. This would mean about a 4% annualized headline inflation number. The bottomline of this is that I see FED cut rates in September. Not before that. As I have mentioned before, as long as these rate cuts are postponed, they provide a bid to the underlying US stocks as more money flows into the US from foreign traders and funds. The FED is owned by the private banks here in the US. The FED will do what they want it to do and this time it is to delay rate cuts so the banks can capture more and more foreign flows to enrich themselves. Make a few extra billion dollars while they endanger trillions of dollars of their mortgage portfolios. Smart ideas from very smart, Ivy League educated Wall Street bankers. What can go wrong?

For instance, if you look at the ECB. This will be the first time in history of the ECB that ECB will make a move before the FED does. The ECB, I am confident will begin cutting rates as soon as next month. This fuels the carry trade even more. For instance, if you look at the USDJPY, it has comfortably now been perched up above 155 again and I think it should sooner or later make another run at 160.

Due to these factors, my primary bias is that a sell off due to the stronger than expected CPI or even a 0.4% headline CPI could lead to a dip and this dip could be supported as long as 5140 holds. The edge case scenario for me will be if the CPI came in at 0.2% for the month, which I personally highly doubt.

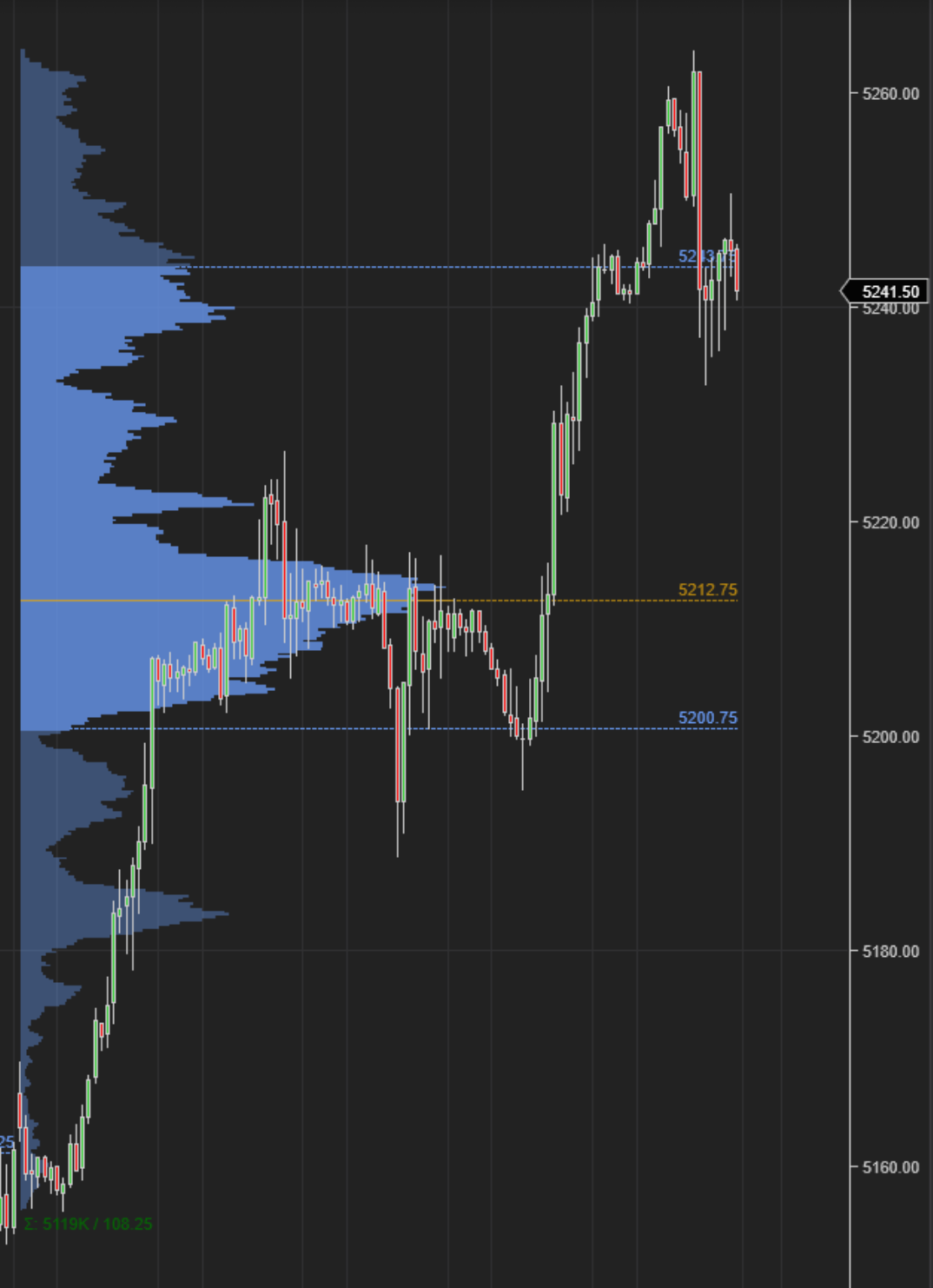

Let us review Chart A below.

Chart A is the Weekly emini auction.

You see a narrow gap between the Value Area High and Value Area Low.

You see almost no volume at 5150 area and some volume build up near this Value Area at 5211.

This could denote weak buying here near 5250.

Now the primary expectation from previous week was to see support come in at the HVN of last week at 5130 and then float up to 5211.

This was the correct call as we dipped briefly into this area and then we rallied hard into 5211.

Over the week I cautioned the bears against acceptance here at 5211. Once we started seeing acceptance at this 5211 zone, the next logical move was to move up to 5250-5260 area, as mentioned in my Wednesday and Thursday Daily Plans.

Scenario 1: I like to think that 5150-5160 could play some role next week. If we dip into this area but do not take out 5140-5150 and by that I mean we do not see a Daily (D1) close below this zone, then this could be supported for a move back into 5211-5220.

Scenario 2: If POST CPI, we are trading above 5200, I think this sets up for a move higher into 5330 recent highs. Conversely, if Wednesday close is below 5140, then this opens doors to a retest of 5000.

To summarize: my current macro context is based on a continuing flows into the US markets because the international markets believe the FED will be the last major Central Bank to begin cutting rates. This is leading to positive carry flows into the US to earn yield as well as invest in high quality US stocks as perceived by the international traders. This story I think remains intact unless we begins seeing material weakness in the US dollar and the cause for that will be a series of weak prints in CPI, GDP, Non Farm Payrolls etc.

On the technical side, I need to see some Daily closes below 5130-5140 to get a technical confirmation that we are headed lower towards 4800-5000.

These weekly levels are from Emini June contract. On the SPY side, this means support near 511-512 if traded to move back to 516-517. As long as there are no daily closes below 511.

This is a wrap now. Have a great week ahead!

~tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.