Hey guys..

Welcome to another daily plan in which I will be sharing my personal thoughts on catastrophic account failure (in other words getting bagged) and how to avoid it.

But first let us talk about the CPI.

The CPI came in at 3. Yes, 3%!

I have no idea how this was calculated but apparently CPI is now 3% even when the housing prices and rents make new highs, energy costs remain relatively high and food prices remain near all time high.

Let us however believe that the CPI is 3% indeed. What is next then?

I think this number allows the FED to begin cutting rates unless we see another uptick in August CPI. If that is indeed the case, I also do think that where the current markets are, they are pricing in perfectly FED rate cuts not hikes when you look at S&P500 near 4525. This means that the FED can now declare a victory on inflation and the focus needs to shift to the next reason for the FED to begin easing again in terms of Quantitative Easing (QE). If inflation has come down to 3% and the economy remains strong with no recession, what are the justifications for a FED QE cycle?

It is one thing for the FED to be buying billions in assets every day (QE) and it is another thing for it to be selling billions (QT).

These are some of the questions that should be front and center for this market next few quarters and months.

In terms of some of my calls, Gold and Oil both had superb rallies off the backs of Dollar decline.

Dollar as expected by me fell from that 103 to close near 100 level. Dollar does look like it is going to break that 99-100 support and should begin a downtrend with the LIS around 103-104 level.

Going back to my point about Gold, it has same macro factors support it that I had mentioned a few weeks ago. It saw a nice clean bounce off my levels to close here near 1960 and I think it may clear 2000 as well.

NEM

Gold miner NEM is also up handsomely from my 40 level to close near 45 today. I think it may remain supported at 43-44 to test 50-55 again.

Catastrophe

To understand the mechanics of account failure, we need to zoom out and understand the trader psychology a little more. I have interacted with 100s of traders both online and offline. I have come across seasoned pit traders as well as very new traders having started only a few weeks ago.

What I observed separates the veterans from the newbies is understanding of one key thing - no, this is not a deep understanding of some holy grail methodology or a realization of some secret method that only a few know. It is simply that the experienced traders understand their average day. They use this information to determine how much they are willing to lose on any given day.

As simple as that.

To give an example, let us say my average a day is 5000 dollars. It is just an example. For different people, this number could be different. It could be 50 for one guy and 5 million for another. Does not matter what it is. What matters far more is that do you even know what your average day is or is it just a trial and error?

Very few traders know or even want to know how much they make on average every day. And it is not to blame any one- some of us are so new to this. To get averages like this, we need to have at least a history of 1000 days or so. If you have been trading for a 1000 days and you do not know these ratios, then I think there is no excuse for you!

Why is this important?

Because if I make 5000 on average then I do not want to lose 15-20K on any given day. Losing 1x to even 2x that average in my opinion is ok but trouble starts when I lose 4-5X that average. I then know I can not bounce back in next day or the same day even and that is when I begin making some really bad decisions which all but ensure my account gets bagged. This is #1 reason of a catastrophic account loss in my view.

For any budding trader, I think it is important to do an analysis of 1000 trades or more about a few key ratios. How much does she make when right. How much she losses when she is wrong. Losses will invariably happen for any one regardless of their experience.

Losses can not be avoided. But I think what can be avoided is having losses that far exceed our average profit. If I can do so, I can make it back up later in the session, in night or even the next day. However once I have crossed my threshold, I am making one bad decision after another and that is a recipe for disaster.

This is really my 2 cents but I do firmly believe until we figure out these averages we are really flying blind because if we do not know these averages, then it is very hard to gain confidence. It is hit and miss, right. For me confidence comes from knowing these numbers. These are personal, they vary from person to person but once you have a good grasp of these numbers, I can still make stupid decisions but at least I know I am not coming back from those decisions. Very rare. I have bounced back but that is very rare.

The action today

I had expected the resistance to come near 4510/15450 today which was the case but the lower prices could not be held. These are ES and NQ prices respectively.

At end of the day, we closed back at these levels having briefly ventured below for a few hours.

For tomorrow my main levels will be 4486 and 4519. We are now at 4515.

Scenario 1: more range action between these levels.

Scenario 2: Trend day may form either below or above this, targets 4460 and 4543 respectively.

A common question is how I have these levels when the market has not yet traded 4543.

That is not correct, it has traded those levels just not for this particular contract. These are key levels from older, expired contracts which I am reusing.

Asides from these, some other new highs today, including FLEX, SNAP, JPM and PCG. These names like PCG were shared by me in Winter around 12 dollars. SNAP at 8!

CVNA had another 15% day today finally trading 40 before cooling off.

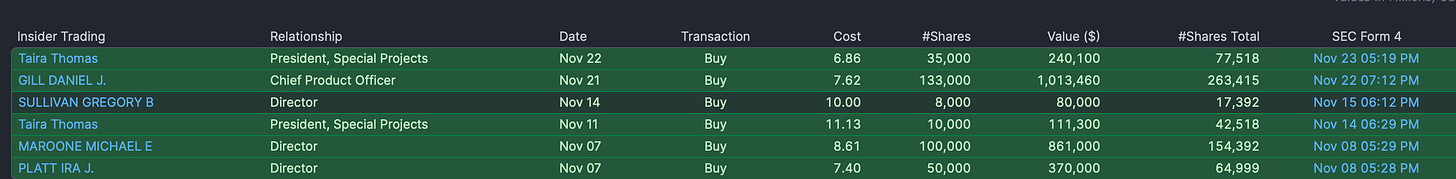

CVNA is a classic case of insiders buying before the massive run up.

Wish this could be said about many of other names that are up quite a bit but see on balance, insiders selling a lot. This was another confirmation for me for CVNA at 11 bucks that the stock had insider backing before it just took off.

One thing I want to share , which I feel is important is that I have shared these 20 or so names like CVNA in last month or so alone- this action looks very good and the whole market looks very active, in particular small and mid caps. I have myself been extremely picky in what I share and some of this was in the list I shared last night. I may continue to share many more such names, dependent on market momentum of course. Much more to come. Stay tuned.

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal and personal opinions.