Pretty much every single day of the last week, we sold off in the S&P500 index and we sold off even harder in the tech heavy Nasdaq index, thereby shedding about 170 points on the Emini S&P500 index from High to low.

Last week, I cited 3 reasons why I could not be bullish at the Weekly OPEN near 5710 the previous Sunday-

Rejections at 5710 key order flow level.

Elevated VIX readings above 13.

Tighter bond yields to end the previous week, despite fairly good data as perceived by the markets.

While the sell off felt quite vicious, in grand scheme of things, this is a less than 4% move in a week. S&P500 has come off about 3% from its highs. For context, this market is capable of moving 400-500 points in 5 days, under the right set of circumstances. However, for what it's worth, I thought the market was quite tradable throughout the week and a welcome relief from the humdrum of 15-20 point sessions.

Looking at the week ahead, there is little event risk until Thursday and Friday when the GDP and core PCE data comes out. However, there is some important data points coming out of Europe early on in the week that could be market moving.

As far as the individual stock names go, last week I steered cleared of mega caps like NVDA, TSLA, AAPL etc and instead focussed on some lower beta names such as MARA, PLTR, and Bitcoin. In hindsight, this was the correct take as we did see quite good relative performance in these lower beta, lower market cap names compared to the broader index.

MARA for instance actually ended up 20% higher on the week compared to the general index. Bitcoin had a healthy run to 67000 as I draft this post. Now this goes back to the nature of Orderflow as a methodology and what I shared as an important analysis tool aka Tic TOP indicator. For the larger market cap stocks like NVDA and TSLA to do well, the general market needs to “firm up”. In this type of methodology, it is possible to lose 1-2% of the move but in my view is less risky than catching falling knives. We can randomly buy any stock at any price and hope for a good outcome. Or we can wait for leading indicators like Tic TOP to firm up and then play on the bullish side.

Yes it is possible that in such a methodology, you do not capture the exact bottom 1-2% of the price but it is more robust in terms of defined risk and reward. Compare this to randomly buying stocks when the market is at 5628, 5596 or even 5550- all of these would have failed at time of this post. In other words, I need to see the general market, as measured by price action in the S&P500 index to reclaim some of the levels I will share in subsequent sections before I feel the bullish side has a higher probability of materializing over continued sell off in stocks.

While I see this as a plus, some folks see this as a bane. A lot of folks like to see some action in the market at all times- however it is just not so easy. It is not at all about being active at all times, but rather all about the timing. Most of my readers have a longer term view and do not mind sitting out the periods of time when things do not make sense, but occasionally we do have folks who want to be on the high horse at all times- this mostly ends in disappointment as the markets cannot serve up bullish plays at all times, there are going to be periods when nothing moves or worse, moves in the wrong direction. So bear with me here, no pun.

Folks, I also want to look at some very interesting housing market data released this month by Zillow. Zillow publishes this research for free every month and can offer some interesting insights into the housing markets.

A few months ago I shared how anyone who is in the housing market can probably get better deals towards end of the year and so far the data seems to support it in several geographies.

The housing market has been hit by a double whammy - the affordability stinks. That is because the home prices are far higher than 4 years ago when measured as the median sales price. At the same time, the real incomes, adjusted for inflation are barely budged from levels 4 years ago. In some areas, they are even negative.

If it could not be any worst, the monthly payments are also far higher due to the interest rates still hanging in the vicinity of 7% for a 30 year loan.

Chart A below. Look at the Home appreciations by geography.

You can see that with the exception of some areas, such as the Bay Area which continue to grow strongly with rate of change as high as 10%, most urban areas see growth moderate quite a bit now. In Southern parts of the country, the rate of change is actually turning negative with the Austin area seeing tremendous drops year over year.

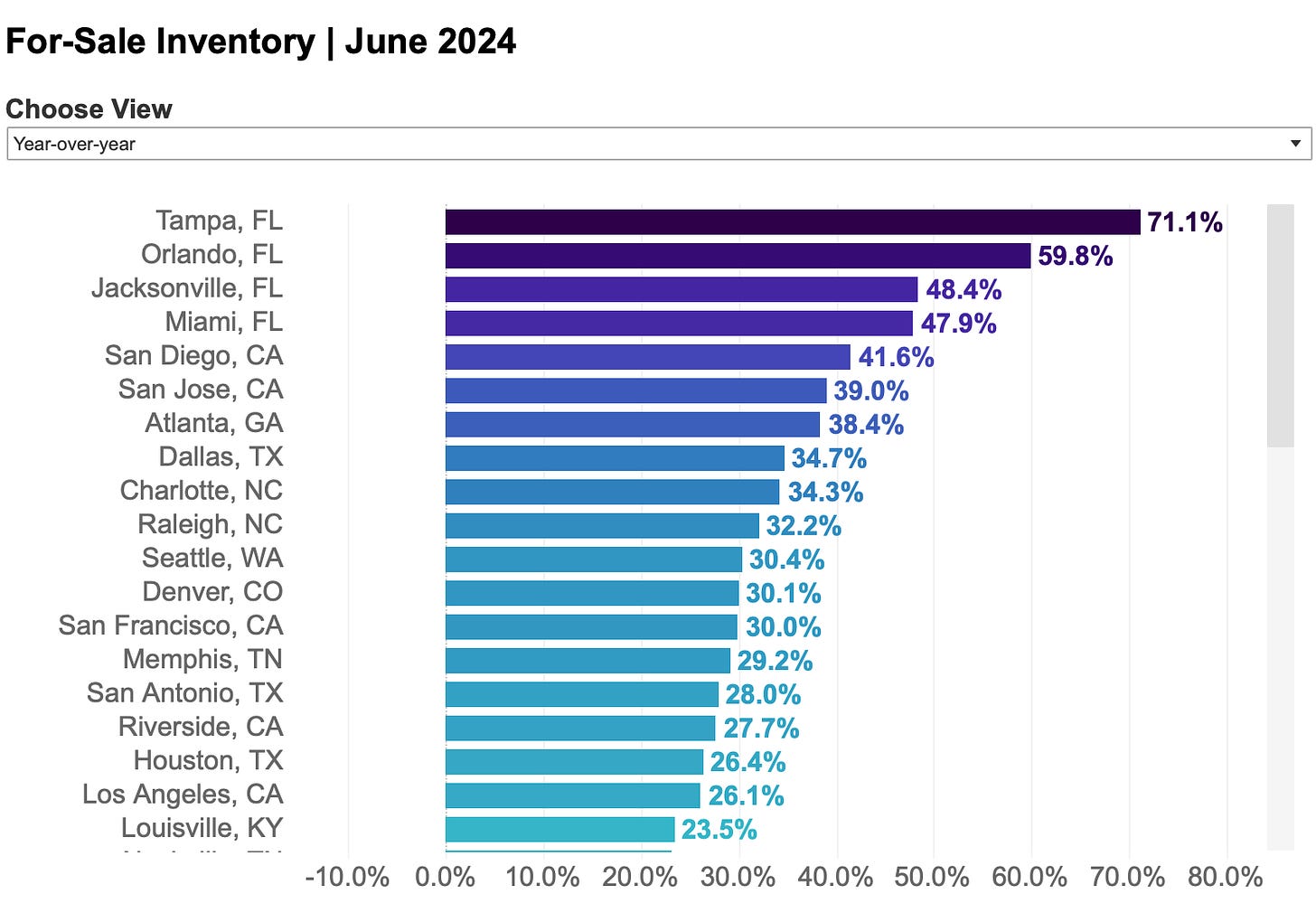

At the same time, the inventories are surging. See Chart B below.

Don’t get me wrong, the real estate market is still for most part a sellers’ market with the metrics being very rosy, compared to a 10 year or even a 5 year average. But this is going to change. Austin real estate marker is the ground zero of what is to come for rest of the country.

If I do not really need a new house right now, unless it was for personal reasons, I think it makes much more sense to wait. Even the rents are now dropping at a faster pace than last year. I think it makes much more sense to rent versus buy in this market.

How much of a good deal? Well if the rates are cut and the mortgage rates even come in slight alignment with 4-5% for the 30 year mortgage, I think it will be possible to get a 10-15% discount fairly easily in less than a year. For a 500K house, that could be easily a 50-70K discount just for waiting a little less than a year. That could pay for 2 years of rent. And at the same time savings in property taxes.

Housing is also complicated, especially in that 300-400K range because you as an individual homebuyer are also competing with the likes of Black Stones of the World- there is a lot of corporation influence on the starter homes which makes it harder for the first time homebuyers to compete. I personally believe that the time to sell a home has passed and it is better to lease it out or wait the tide out now rather than join the frenzy and further depress home prices in your area.

I sort of have similar feelings on the new car prices. If you can afford to drive the clunker another few miles, I think there will be extremely attractive deals in near term as we approach Christmas. Already I am seeing thousands in discounts in new vehicles, primarily around the midwest region. This has not spread to other regions yet, but it is a matter of time. You could get extremely attractive deals in cars, 5-10% or even more off if you wait another 4-6 months.

XHB

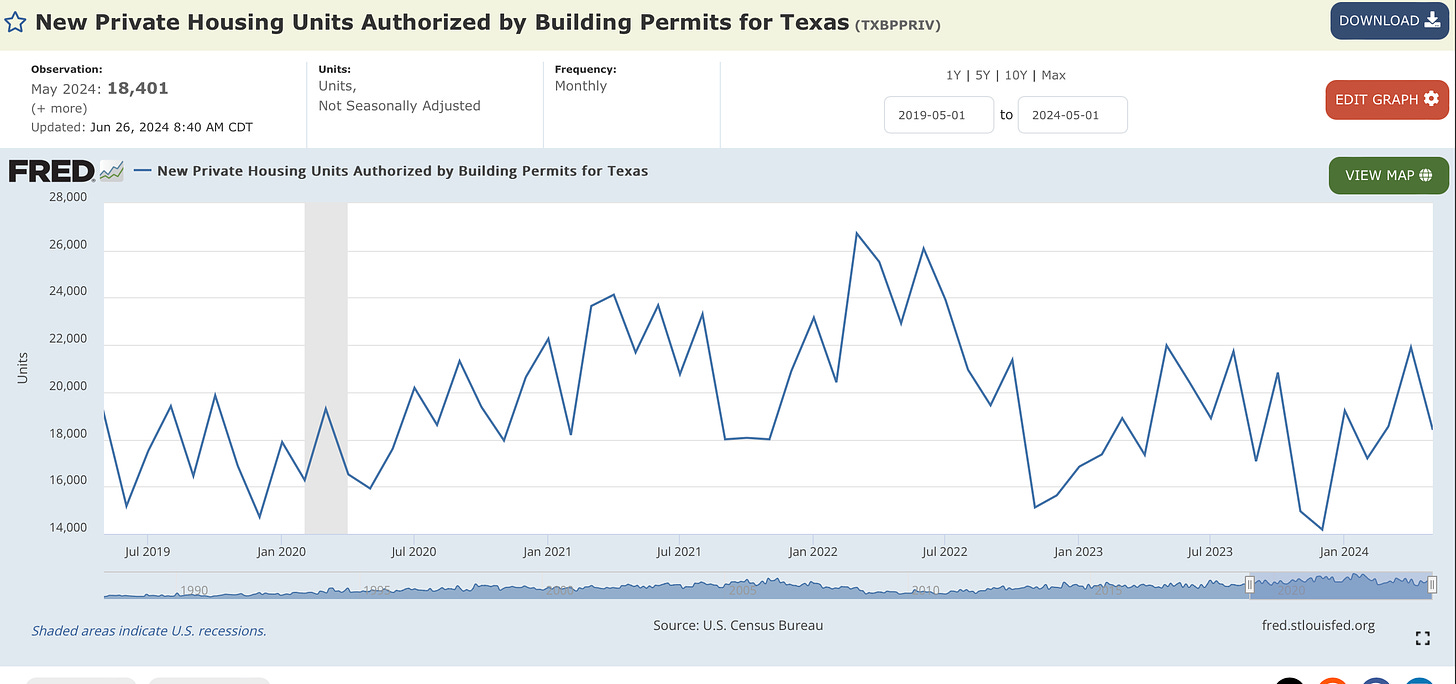

Look at Chart C below for housing building permits issued month over month.

Back in 2022, I called for a bottom on the home builders index at 80 dollars before it ran up to 120.

What is so different now in 2024 compared to 2022?

The builder confidence. The builder confidence was at peak then represented as a surge in building permits. This means the home builders are positive about the future and want to bring more new construction homes to the market. Now this is depressed. This highlights the pessimism in the builder community for months ahead.

The new home builders now also are going to have stiff competition with the existing home sellers. This was NOT the case in 2022. Very few folks wanted to sell. Now if you look at Chart B above, there is going to be an explosion in supply from existing home sellers.

On a side note, as a potential home buyer you want to avoid buying older homes in areas with a significant number of new homes, compared to older homes. This is because in a few years down the road, you will have a harder time selling an existing home when there are so many relatively new homes in the neighborhood. While this is not true for established, tree lined residential areas, this is extremely true for new up and coming communities such as the suburbs around dense urban areas.

Anyways, look at the XHB index. I think this is the last hurrah before a significant downturn for the home builders.

Is this a bear market or just a dip?

It does not matter. What matters is the time in markets, not the timing when it comes to long term investing.

Look folks, here in this Stack, I share short term daily plays as well as some themes which are relevant for years and decades.

Here is my very basic philosophy about investing and I mean it wholeheartedly. I wish I knew this when I was starting out very young in my early 20s. This concept is so simple but so easy to ignore. The concept is called Compounding or rather the magic of compounding.

So what will I tell a 20 year myself? I am sharing this as a personal lessons learned, and I am distilling down my learning to the readers so you do not make the same mistakes.

I will tell myself that tune out all the noise from the so called experts. Focus on the time in the markets, not the timing.

Let us say I am a fresh eyed 20 year old, or even a 25 year old with 100 dollars saved up every week. This is not a big deal, most 25 year olds with a college degree and/or some sort of a stable job, can save a 100 bucks a week. You can save a 100 bucks a month just by cutting down on Starbucks and Happy hours, so it is not hard.

Take this 100 bucks and plough this into some stable, low cost ETF. I am sharing some ETFs which I personally like for such an endeavor.

I simply plough my 100 dollars a week, every week and NEVER sell. Do not listen to Kramer. Do not do what CNBC pundits tell you to do- simply keep compounding.

Do this for 40 years and you end up with a cushy 2.5 million dollars. Assuming a 10% long term market gains per year. This is just compounding that $100 a week. You can do the math what the numbers look like for a 50 bucks a week or $500 a week. Now this is not a get rich quick scheme but this is building assets over a long period of time, leveraging the wonderful US public markets. This is more relevant for those who like stability and long term wealth building.

Time is the most important ally you have. Longer your time frame, more power you have over your future. The same strategy for a 35 year old person will net about 750000 dollars. For a 45 year old? Barely one tenth of that, a mere 250K. So you can see how important compounding is and how even more important is to start compounding earlier than others. Now most of our readers may not be fresh out of college 25 year olds, but if you know someone who may benefit from this, please consider sharing and letting them start on the right track right off the gate!

Are there any sort of ETF or markets which are better for this type of strategy?

I think so. I personally see the biggest risk in the market right now is that of concentration. You have a handful of stocks which are simply too big right now. NVDA, AAPL, MSFT, ASML, TSM.

These are all great but they are extremely concentrated in terms of not only the market cap, but also how widely they are held by almost every pension fund globally. This is an issue. This is going to be a big issue down the road.

In meantime, there are funds out there which are more diverse and less concentrated. And by being less concentrated, that one factor alone makes them less riskier.

For instance VDE. This is one of my favorite funds and I understand it quite well. There is always a room for me to invest long term in VDE.

However the problem with VDE is that it is not at all diversified. It is all in on energy.

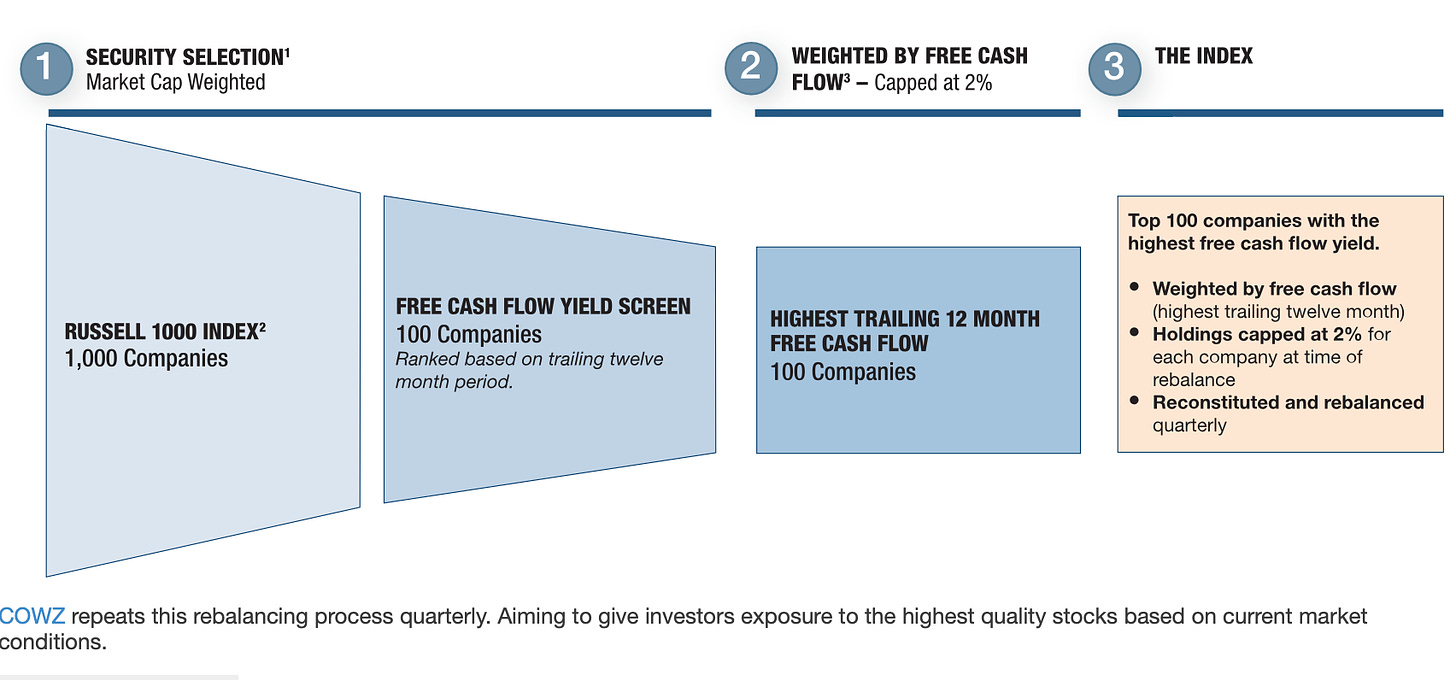

For something more diversified, I look at something like COWZ 0.00%↑ .

One thing I like most about COWZ is that at any given point in time, the maximum they can hold of any stock is 2%. Not more than that. This fund has also outperformed the S&P500 since inception and in fact also did better than the broader market in 2022 bear market. I think this fund will continue to outperform the broader market for next several years. It is 56 at the moment but if it drops to 50, I like it. If it goes to 45, I like it more. And if it drops to 40, I really like it. Again, not some short term play. This is investment time frames of several years.

The COWZ fund managers screen Russell 1000 companies (smaller companies so more upside potentially) and find the highest Free Cash Flow (FCF) yielders out of that index. They keep the TOP 100 companies out of that list and they repeat this process every quarter. The max a company exposure can be is capped at 2%. This is really an excellent strategy in my view rather than having only the tech heavy, SOX stocks in my account.

What do you think about such an ETF? Let me know.

On the short term side, for those of you who may not be aware, both VMFXX for those on Vanguard platform and BlackRock TTTXX for everyone else, are both excellent options. They are both yielding in excess of 5% at time of this post. BTW for those who have a premium account with Robinhood, they are also offering 5% on any cash parked in the account. I am not affiliated with any of these, I am just sharing this as FYI.

Short term levels

Key emini weekly levels

Folks, look at Chart D below.

What do we see here? We see two things:

A multi-nodal volume profile indicating trending market.

HVN formation below the Weekly Value Area.

With the Emini, another challenge for me personally to like these levels here around 5550 has been the lack of enthusiasm in Pace of Tape (POT). Due to these reasons I am watching this level around 5600 level which will be my key level for the week. We are now 5550.

Scenario 1: Bears may have an edge as long as we hold 5587-5600 to target 5522-5530s on the week.

Scenario 2: Normalcy could come back to the markets if we see back to back closes above 5600, which may then target 5638.

Slightly for longer swings, I personally favor 5300s or even low 5400 for support to come in for a nice sized move back to the 5500.

Earnings

TSLA

Tesla is a recent breakout stock that I shared at 170 level some weeks ago before it rallied higher into 260s.

This stock has taken a hit along with other mega caps and is now trading at 240.

Earnings are next week on 23rd. I like TSLA to rip higher into 270s but I cannot rule out some short term volatility, due to the general market conditions. With this said, 217-220 is my Line in Sand for TSLA. I think if it dips into 217 for the earnings, this level could be supported for a move higher into 250s.

AMD

AMD earnings are not until later next week but I am watching this 157-162 level. The stock is now about 151 dollars.

If AMD were to retrace back to 160s, I am curious to see if this August 16 $140 PUT currently bid at 4.2, can be had around $1 or less.

At any rate, with these SOX stock like AMD, I see the bulls need to take out 162 on the upside, else I think we are headed lower into 135-140 area.

This is it for now.

Have a great week ahead!

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.