Hey guys -

This is an important post. Make sure you read all of it. In this episode, I will share why IB is so important and how I determine if a level is going to hold or fold.

I will also spend a couple of minutes to talk about the long range nature of some of these calls that I make.

Let us begin with a quick recap of the session…

From last night’s plan, a couple of things stand out…

First off, RUN stock ran today.

And it ran a lot before giving up some of its gains. The stock was up around 10% at one point before it sold off.

I also had a bunch of good calls on Gold. Gold finally captured that 2000 level almost and continues to look good along with dollar weakness.

I want to be cognizant of the long term nature of my calls. Why is this so important? Because it takes time for the world to realize the value of the call. If everyone realized the mispriced opportunity at once, there will be no price movement.

Let us look at some recent examples below.

When I called the PLTR low at 6 bucks , that was last June. 26th June to be precise. It took us over a year to get here to 18. A 300 % rally.

See below.

When I called the MARA low at 3 bucks, that was back in January.

When I called CVNA low at 3, it was even further back in December.

Even something like UNH which I shared at 450 low, it crossed 500 today, this took about 2 months to get here.

There are dozens of examples like this all over the place. These type of calls just need a lot of room to develop and then run. They are not weekly or intraday time frames.

Now on the trading side intraday, it is a whole another universe. You do not need to be a good investor to be a good trader and you can be a bad trader and yet be a good investor. And vice versa. Trading is impacted by many things - your energy levels, your age, your mental frame, your mood. In my case, if I have had good sleep or not etc. So trading is a very different beast than investing IMO. The two are like ice and fire.

CVNA was another one from weekly levels which was up like 15% today. Again, this is why I am not seeing key order flow levels make lower low yet. Eventually they will - however when they do, it should not be a guessing game any more, we should be able to see it on the tape making lower lows rather than higher highs.

TSLA target of 300 achieved almost as well. Shared around 280 over the weekend.

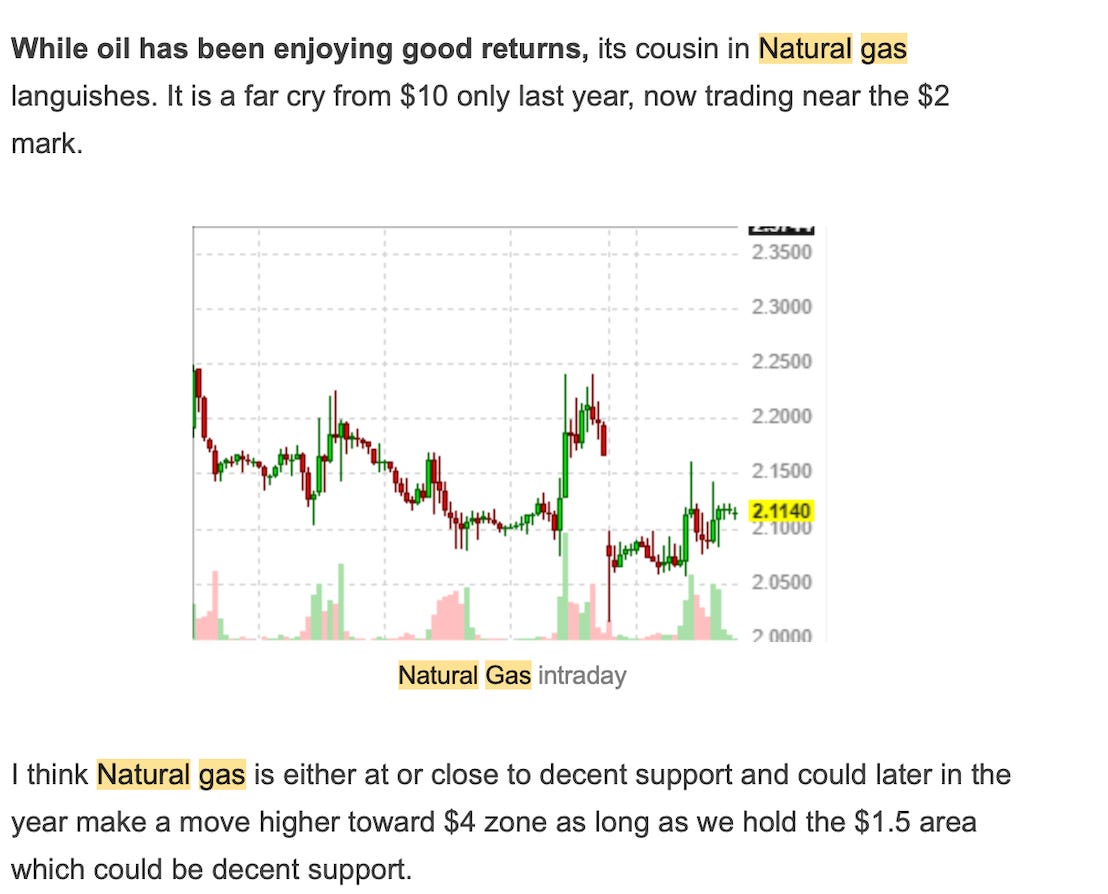

Even something volatile like natural gas is up about 40% from my levels but it did take about 6 months to get here from March.

Anyways, the following is an important subsection so I have to put it under paywall. Sorry but you can pay and get to read the rest if you are active intraday and interested in my thoughts.

I will share how I measure if a level will hold or fold by taking that example of 4556 from this morning.

All night we traded in a tight range with 4556 as the high of the night. Now a lot of folks think if I share 4556 and we are below it then I am bearish.

That is true. 100%.

However what is not so well understood is that once we take out 4556, am I still bearish?

I am not.

The way I view the market, I view it in terms of price levels. I do not have a bias. I only have levels to lean against intraday. I am bearish below certain prices. And I am bullish above same Price levels. It is so easy concept yet most struggle to wrap their heads AROUND this very simple concept. I dream in terms of levels. Newbies think because I have 2 scenarios it must mean I do not know what the market will do today. For the record, I do not have any idea what the market will do today or tomorrow. Ok. Let this be known. But I have already thought about what I will do based on what the market will do around my levels. When we begin to see volatility hit the fan, then it is far easier to deduce what the market may do imo. In very low volatility, this is extremely hard if not impossible due to the MM selling options in a tight range which leads to bracketing (trend-less days). This is more for intraday. My calls above on longer term speak for themselves.

So, how do I measure if we have “taken out” 4556 or not. There is no hard and fast rule. It is more art than science. However, rely heavily on below two concepts: