China finally succumbed to the easing itch and gave in to issue almost $300 billion dollars in new stimulus fueled by magic money printers. This is said to revive and meet 2024 GDP targets.

This lit a fuse under the Chinese stocks which had been under doldrums for several years under performing world markets big time.

Nearly everything was bid up. Stocks like BABA had a 20% week. This led to a surge of new interest and new buyers in Chinese stocks like BABA at 100.

In all fairness, we cannot say we did not see this coming.

See below for my post from February-March of this year on BABA and SE, when these stocks were near 70 and 65 respectively.

Similarly, I had bullish views on JD when it was 20-25. Similar view on KWEB ETC.

While the Chinese stocks rallied hard, this stimulus news also benefited a wide range of other high end companies’ stocks, like Louis Vuitton, Las Vegas Casinos, Coach and the Ferrari maker.

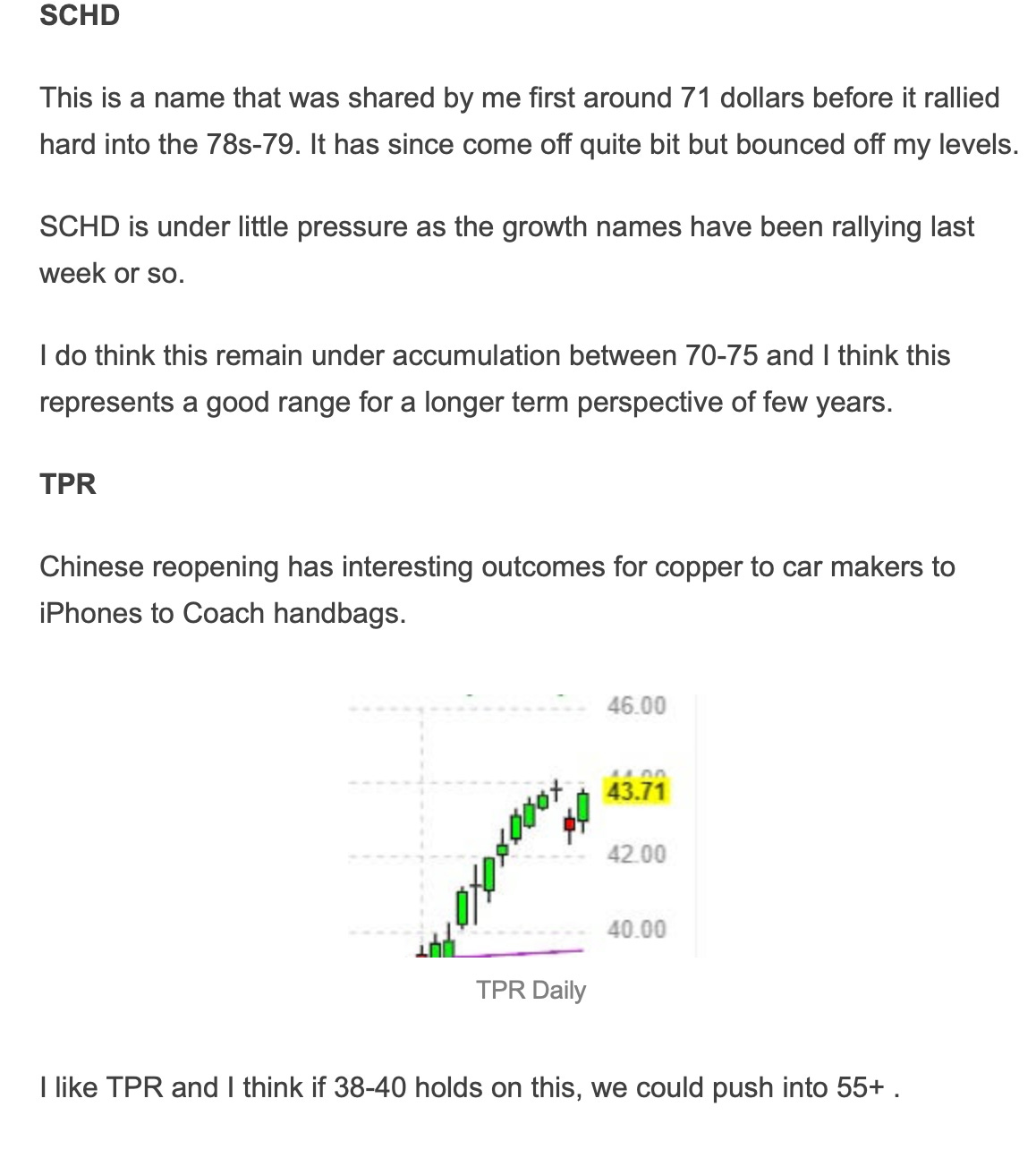

Here is my DD on TPR one year ago. Check the lows on this stock in this swing, whereas now it is trading near 47.

As a momentum trader, I see nothing wrong with buying BABA at 100, but buying BABA at 70 is even better. I always like to buy stocks when they are in accumulation and once other investors realize what I am seeing in my thesis, the stock goes vertical, it then goes into what I call the markup phase. When extremely few traders realize value, the price is lower. When more and more traders realize value, the price must rise and it must be marked up to accommodate all that new surge in interest. Auction market 101.

These type of calls are not only in any one sector or industry, for instance, as far as energy goes, see below for my DD from early this year. Now go look at the CCJ lows right now.

The common theme in all of these investing themes is that investment themes do not play out over a 0DTE or weekly time frame. These are months to years’ time frame we talking about here. Any good investor will see value months and years ahead of others. It takes time for the crowds to catch up. Crowds, by their nature, do not realize what you, as a value investor, have realized overnight. This is why I say, always take a long term view to these investing themes and ideas.

Can this higher China trade trend continue or fizzle out?

I have no idea but I do have some thoughts about key levels on some key players in this space.

But first let me share few points about the thought process that goes in developing a long term thesis like BABA.

While developing this weekly newsletter, I will often go thru dozens of stocks, shortlisted from technical screens. I will then do a deeper dive into options, technicals, charts, fundamentals, macro etc and then weed out most of those to select a couple most potent ones.

A recent example of this is SMG, or Scotts Miracle grow, a lawn care product company.

The stock recently broke out which attracted me to it. Usually 3rd and 4th quarter are slow quarters for something like SMG. When the stock breaks out of a range in October, when no one is buying any grass seeds, this is something worth noticing.

Now you do deeper dive, recent weather disasters are good for SMG. Lower rates are good for SMG, just like HD when we shared this at 350. More home sellers come online, the more they use SMG products to bring their home to market. These are all great factors. What are some of the red flags? The margins suck. There is nothing unique about their products. 50% of their sales happen at Garden center in Home Depot. They have acquired marijuana focussed company, which is a risk in itself. On top of that the stock is at 85.

Don’t get me wrong, I still like SMG, for an eventual push into 100s, but I would have liked it even more if it was 75. So while I like the story, I do not like the valuations at 85. In this case I will drop the idea, and move on to the next one.

I may do this for 15-20 stocks every week and shortlist may be 4. So you can see this could soon become pretty time consuming and intensive to do this sort of DD, week after week.

Problem with analyzing a lot of these foreign stocks like JD, NIO, BABA etc is that they tend to be opaque in their balance sheets. These countries do not have the same type of accounting controls, checks and balances like we have here in the US. By law, in the US if you lie about your company’s balance sheet you go to jail. So, in that sense, I wanna use Tapestry, the maker of Coach handbags as a proxy for the wider China trade.

TPR is now trading 47 and change, I think if this China trade has legs, I do think that we need to hold 44-45 handle on TPR. Minus that we could see some adverse moves.

I think if 44 on TPR were to hold, TPR could head higher into 58-60 area. At the same time, strength in TPR could be translated to strength (or weakness) in China stocks.

As a short term lotto, October 18 TPR $50 calls are 70 cents. I think if had for 50-70 cents, this makes sense, purely as a lotto.

This translates to roughly 94-95 on BABA. I think if BABA were to hold 95, we are headed into 130s. It is now 107.

There is a lot of noise on internet where some are calling this spike to be head fake, whereas some are calling for this move to continue. But for most part, there is no objective reasoning provided to measure this.

Here in this Substack, I am offering you an objective way to measure if this move has legs or not, using related market analysis and giving a very tangible level to lean against to measure this move. Subscribe now to receive more such cutting edge analysis tools.

Let us talk about the other momentum darling CCJ

Look at chart below (via Trading Economics) for current price of Uranium as CCJ is considered a direct proxy of Uranium prices.

We see that the prices are neither here, nor there. I think the uranium is fairly priced here at 80 or so per lbs.

This is a bullish Uranium chart and I think slightly also decoupled from what the economy itself does in next year or two.