Folks -

Interesting day to say the least with a couple of things piquing my interest.

One of these was Microstrategy’s MSTR 0.00%↑ Saylor claiming that he owns in excess of 152,000 Bitcoins.

This was said as a matter of pride. However what he did not mention in his tweet was the fact that his average price is near 31000 USD.

At 152000 BTC, Saylor is one of the largest Bitcoin holders or as they say hodlers.

There are other large whales too who own 2-3% or more of the total supply of BTC. However, what they don’t tell you is that they own it at cents on the dollar. They bought it when it was sub $1. And we have our genius here who is putting his publicly traded company’s shareholders and bondholders at risk, putting all the capital into this one speculation. Look, I am a crypto bull too.

I have also shared many ideas like MARA at 3 dollars, COIN at 50, SQ at 50 etc and I have shared bullish FDIG at like 8 dollars. It is above 20 now. Don’t get me wrong - I like crypto as technology and I own crypto shares. However, what I do not see is putting all your eggs in one crypto coin? Why?! I do not get it. As Investor Tic I will probably continue to hold crypto stocks and park it as emerging tech.

With respect to MSTR, I personally think they will issue more and more debt and more and more stock will be offered for sale to support this unhinged gamble and I think this company will at some point be no more. It is hard to believe while it still trades at 450! Truly sad.

The other news was that ratings giant Fitch finally woke up and downgraded the US Log term fx rating from AAA to AA+. The news was conveniently released after hours and I suspect it will cause some softness when the market reopens for business.

What matters even more is some of these S&P500 companies have billions of dollars in bonds issued and will have to pay it back and will need to finance more debt to even remain operational. I think they are at much more greater risk. I think a name like T has far higher chances of defaulting than the US ever will come close to.

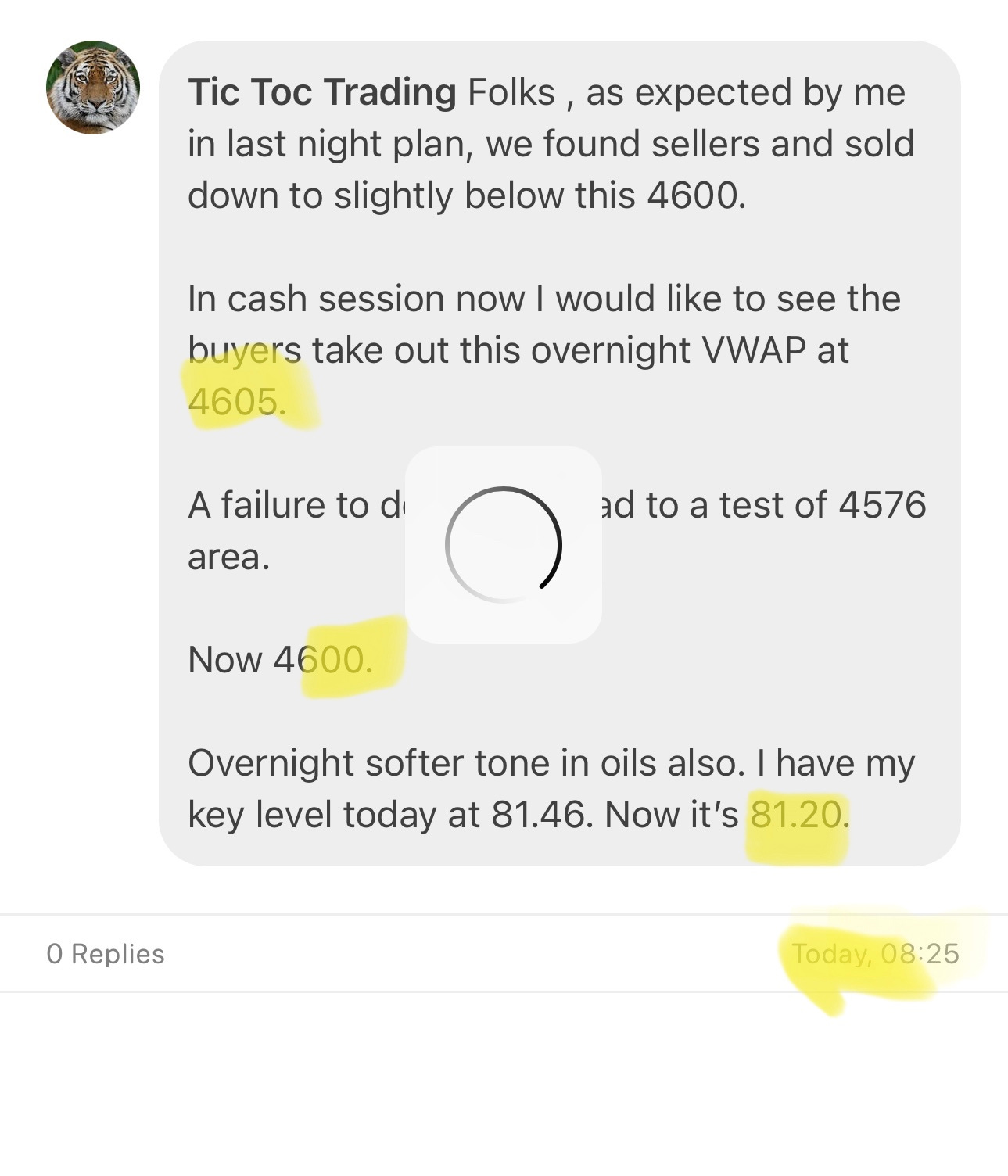

As far as the session goes today, the below one level ruled the session. Not on in the ES but on Oil side also my levels pretty much contained the session on both ends. It took a while but the market just traded my target dropping slightly below 4576.

This is not counting the overnight session which also remained within my 2 levels from last night. As far as I know, no other service is able to offer levels like this, for any price. When you look at these levels, we are seeing the market may be try a couple of points to take them out, fail and then fall 10, 20, 50 points.

Key levels for tomorrow

4576 and 4605.

Scenario 1: I could see some support come in near 4576 . The bears will need to push beneath 4576 to reclaim that all important 4550 area.

Scenario 2: For a trend day, I want to see either of these levels give up fairly early on in the day with that ADP payrolls as major news tomorrow. For trend day, I think we need to see a break of either 4576 or 4605 on the upside.

CVNA

From last night plan, as expected, I saw good rally in CVNA today despite the general market stinking.

This theme could continue above 50 dollars in CVNA to push into 54-55, if we see the market remain supported above 4570 area.

ASAN

I am liking the action in ASAN now as long as it does not dip below 20/21 dollars. It is near 24 now.

I think it could push into 28 and if 28 were to give up, I think we could see 34 dollars tested on ASANA.

Subscribe below for your own newsletter almost every day.

MRNA

Closed today near 112. I think if we hold 110-112 on MRNA, I think we could see a retest of 120. ER on the 3rd. There is an expected 8% move for this stock on the ER.

AMD

AMD ER I had expected a test of 125 at some point next week but we got there today itself. I had shared 125 expiry for 8/11 which was 2 bucks but will probably open above 4-5 tomorrow. I expected a shallow pullback which did not happen. Such is trading. Still better than being bearish on AMD on a day like today.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.