Trader friends-

The inflation report is running hot again per media, earnings season has started, and the war hawks are baying for more conflict, all the while semiconductor stocks enter bear market.

There is a lot to unpack, this is going to be a good post and an insane week! So stay focussed and trade what you see, NOT what you think or hear on the internet!

Let us quickly review the prior weekly plan and how our levels performed.

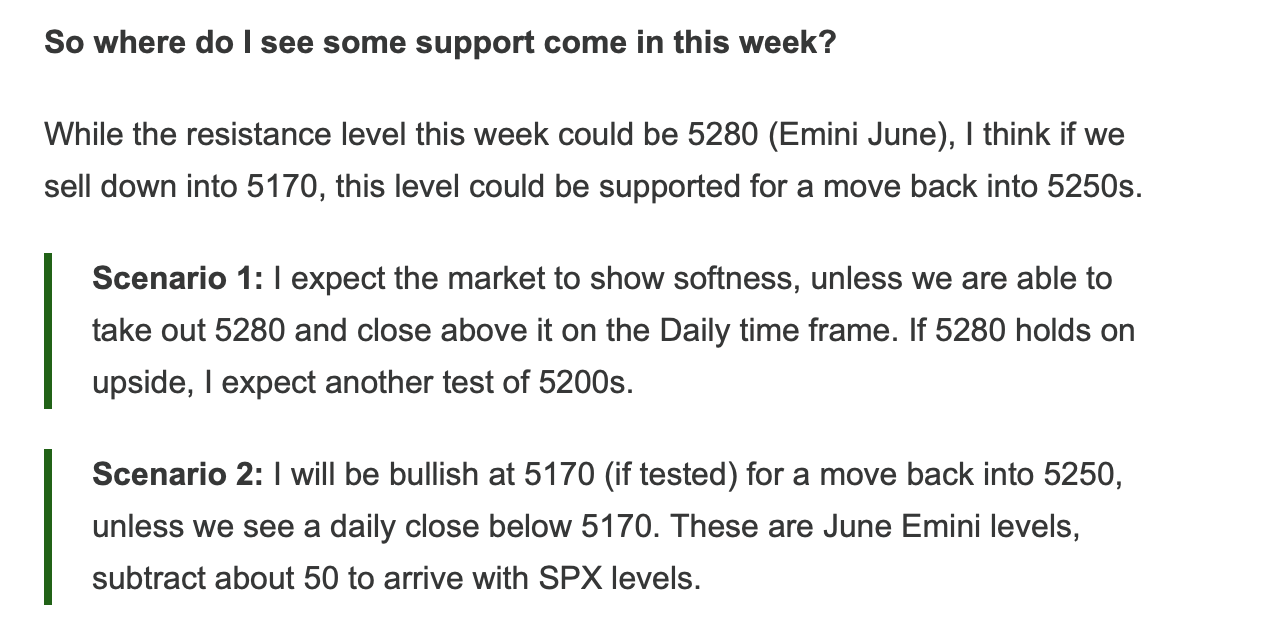

The main expectation for me was to see us sell down from 5280 level. See below from last week’s plan.

Image A and Image B are from last Saturday. These levels are published before the market opens on Sunday night and are not in hindsight. Now you can go back to the last weekly auction and look at the intraday action on every single day of the week, every single day in 5 days and see how this market interacted with my levels above.

You will be amazed at the accuracy of levels.

You can also have these amazing levels delivered in your inbox every night, but you must subscribe now.

Last week was also the week that VIX finally woke up from its slumber of many months. While the average range of several weeks in emini S&P500 index had been about 40 handles, last week was exceptional with some days even seeing a 100-120 point range. This is 200-300% higher than recent averages. While this can be great for active trading, it also begs the question if you are long at 5280 and we drop 130 points or if you are short at 5155 and we rally a 100 dollars, what do you do now?

The easy answer is you cannot do anything now if you are taking a 100 point heat in the intraday sessions. It makes no sense to me to take 100 point heat in intraday session.

The better question to ask is why would any one take a 100-120 point heat in intraday session?

The answer to this lies in our primordial brain.

The answer to this lies in our psychological makeup.

Look, trading is not a game of right and wrong. It is not. Because when you say right or wrong, you are inherently implying a 100% probability. This is just not going to happen. Show me a person who is very hellbent on being right and wrong and I will show you a person that will not be a trader.

Trading is a game of probability- when you make money, it does not mean you were right, it was not due to your brain power, it just means you happened to be on right side of the probabilities. You can be very right and still lose money. It happens all the time in markets. When you make money, you make it because some other guys came in after you bought and decided to buy some more.

So if you are serious about trading, you need to ASAP do two things- A) Stop worrying about being right and B) start following me, if you have not already.

I love learning about trading psychology and in past I have written a lot about it.

Based on my reading and researching about psychology, I have come to the conclusion that good traders are boring traders. By that I mean when good traders win, they are not too happy or excited about winning. And when they lose, they are not sad about losing. In fact, good traders are really good at losing. Try this for a week or two. Try not caring much about losers or winners. You will be happier and become better at trading.

If you take losing personally, in my view it will become impossible to become a consistent winner. The reason being, let us take that 5226 level from Friday which I thought will be support. I am bullish at 5226 for a test of 5250. We have opened 10 handles below 5226, that is a clue.

One hour of the opening cash session is gone and we are no where close to 5226, in fact we are closer to 5200. These are all big price action clues. Due to the nature of my levels, either they will hold with little to no fight, or they will fold very easily. If my level has failed and by that I mean we are now trading 10-15 handles (intraday) below or above it, I think it is going to be very hard to recover from it, based on personal experience. So now if I am long at 5226, and the market is now slipping 10-15, 20 points against me, the worst thing I can do it to add to such a losing trade. The best thing I can do is to get out of the loss. This does two things- a) it frees up my brain power, my creativity to look for next trade b) it removes the risk of me blowing my account up by throwing good money after bad money. Both are good outcomes but only possible if I am a good loser. Trading is the only profession in whole wide world where losers are winners.

This is my conclusion after having traded for many-many years, almost 2 decades:

Good traders are extremely good losers.

Good traders think nothing about losses and such a thought process lets them turn most days into winners.

Bad traders assign too much value to being wrong. For them losing becomes a matter of life and death. Once you make losing a matter of life and death, your brain will freeze. Believe me. You will shut down all other information flow in your brain, once you assign too much value to losing. Do not assign any value to losing. Just take it casually and easy.

Even good traders amongst us can become bad traders for a day or two. The best way to be safe on such days is to stop trading after a max daily loss is reached.

Such flexible and fearless thinking also has another upside. Once you become a good loser, you understand that any or all of next few trades can be losers. Due to this reason, you stop searching for the “holy grail” and you start thinking in terms of probability. Such a mindset, once developed can help you become a consistent trader.

Lot of folks cannot become consistent as they spend a lot of energy in search of holy grail. If something does not exist and yet you spend all your energy on it, you can see why you may not ever get there. Is Santa Claus real? I hope as a middle aged man you don’t believe he is real.

So the key takeaways from this segment are-

Become fearless. And I do not mean in a reckless way but accept the losses and profits alike. Do not become ecstatic when you win (become boring) and do not take it personally when you lose. It is just a trade. You do not control any outcomes, the outcomes are controlled by other traders that come AFTER your ORDER is filled. It is not personal! On very active days, there will be atleast a dozen set ups. You do not have to blow up the account on any one setup.

Stop searching for sure shot holy grails. One does not exist. Free up vital energy to observe market and find good trades. Remember when you pay attention, attention pays you back. Guard your attention with your life. Stay attentive at all times.

Mark down the orderflow levels on your chart or DOM or on a napkin for that matter and see how this market interacts around my levels. Does it pick up speed? Does it slow down? Does it see a surge of volume? Does the volume die down? All very important clues you do not wanna miss.

These actions when implemented, in my view will add a lot of value to your trading life. And life in general. Give it a shot!

This is it for now. Have a great week ahead.

I shared this thought today as no one really knows what’s gonna happen next week due to all this uncertainty.

No JK! Subscribe now to read the next part of equation.

Levels for next week

Before we get into the levels for next week, know the limitations of levels.

Orderflow levels are based on some data. Howsoever real time this data is, it is still somewhat in the past. For when an order to buy or sell hits the tape, the order has already become past tense.

Now when I share these levels based on this data, we cannot predict the macro events of next week. For instance, is there a major geopolitics event about to go down tonight that could upend these levels?

Orderflow levels, or any analysis for that matter, can only give us a sense of probability. For instance, if we are above a given level, then probability of x happening over y could be higher. But it can never guarantee an outcome.

With this out of way, my level levels and context is shared below -

So unless you have been living in a cave with no internet, you by now already know what is going on in the Middle East. By the time this post hits your inbox, the conflict will have either escalated or drowned. For now.

As far as other planned risk goes, there is FED speak as well as BOE Chair comments scheduled for Tuesday which will be market moving. My earlier analysis on CPI is that the inflation in the US is being held high due to 3 broad factors -

Shelter costs

Insurance costs

Electricity costs

These 3 are very cyclical in nature and are not endemic in my view. I think these costs are set to drop like a rock which will lead to the inflation coming in closer to 2% with one key caveat- Oil.

Oil and hence gas prices will remain tightly correlated to the 2024 election results. I do not read much into the geopolitics at this time but as we get closer to November, we should get a fairly decent idea of who the next White House resident is going to be. With a Joe Biden or anyone from Democratic Party in Presidency next year, I believe this is going to keep tailwinds for Oil industry. There is also capacity issues with Oil refining which should keep a bid on Fossil fuel prices long term.

On the sentiment side, you probably have a very negative sentiment coming on Sunday night and Monday AM.

On the technical front, see chart A below.

We are carving out value lower for over 3 weeks now. The high of the HVN is around 5220. If you are not aware of HVN, LVN concepts, as a subscriber you get free access to all my educational library. Please refer to the Volume profile posts part 1 thru 3.