Very Dovish FED today- with my prediction of a 50 BPS rate cut made on September 1 coming to pass today. See below.

Then you also have the question of FED Powell jumping the gun when economy is still strong, so it calls into question his intent. So if he is cutting by 50 BPS when things are still good, how low will he go when it actually hits the fan?

Some are saying it is to help Kamala Harris win- I am not sure, may be. Definitely smells a bit politically fishy. I mean this is a reactive FED, they do not have any plan whatsoever, they will do what seems right in the moment.

Now as a matter of running the FED, it is extremely rare that you see rate cuts when the markets are making new highs. Normally when I see rate cuts, it is almost always when something is breaking. Let us give Powell benefit of the doubt and let us say this rate cut had nothing to do with politics, but may be Powell and team know something extremely bad is going to happen to the economy. This is why they cut rates. Is this a comforting thought?

I ignore the FED, I do not think even they know what they are doing.

Let us stick with the facts, let us stick with Orderflow.

So how did Orderflow levels do today?

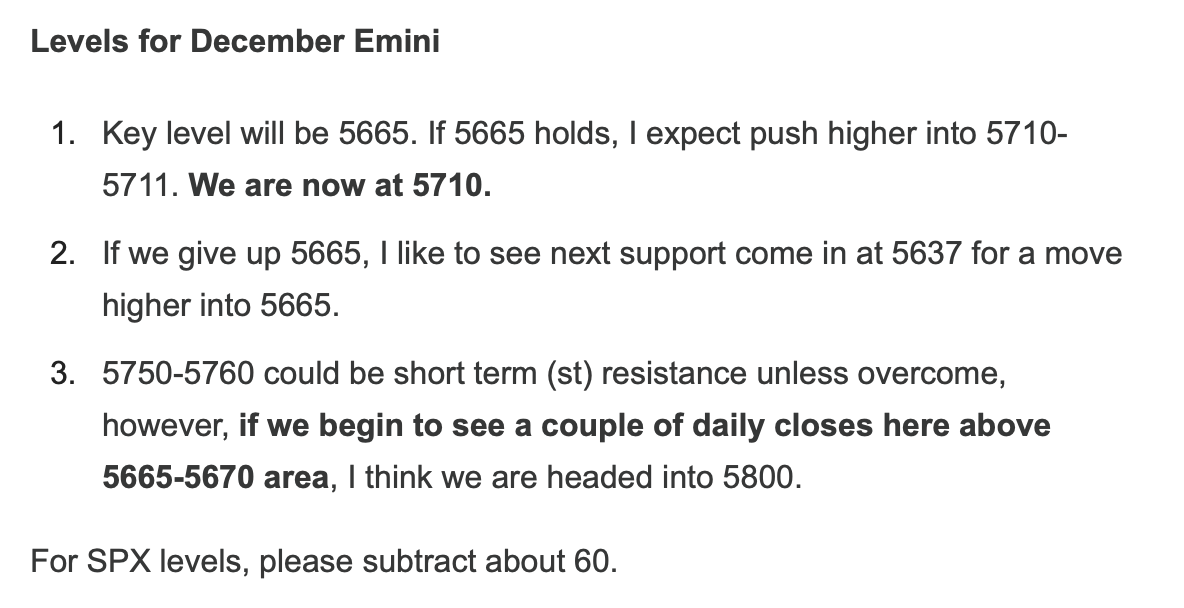

Look at the below 2 numbers from last night. Now go back and check high and low of the session- despite it being an FOMC day!

Hundreds of other good calls - DIS, ENPH, BX, IWM (205 TO 225), ULTA, ASTH, PRMW, AFRM, CVNA, SAP, ROKU, ZILLOW, META, REDFIN, PLTR (6 to 37)- seriously the list is endless, but not naming all as they are for premium members.

Now imagine someone not having these numbers? Buying 5760. Selling the lows of the day.

Can these numbers be yours every day? Absolutely. Click below link and get them delivered daily. Frankly it is a no brainer- unless you are not serious and like to be not in the know day to day.

Levels for tomorrow-

So contextually, the FED has given the green light to another unabashed easing potentially, and left door open to potentially 2 more rate cuts this year. Market rallied initially but failed to keep these highs.

The key levels tomorrow will be 5730 and 5600. We last traded 5700.

Scenario 1: The bulls need to take out 5730 levels on emini, else this may be resistance for a move back down to 5665-5670 (emini December).

Scenario 2: If 5660-5665 gives up, next support could come in at 5600 for a move into 5640s. This is for December emini. Subtract 60 for SPX.

To summarize: the FED today reinforced my perception how reactive it is and may be is also not entirely devoid of political influences. At first signs of trouble, FED ran like a wet cat to the safety and warmth of monetary easing.

While the largest rate cut in over 16 years at surface may appear very bullish, it also brings with it some added uncertainty. This is why unless we are going to breakout of here at 5730 in next day or two, I favor for a reset at 5600 levels. Remember this is going to bull up everyone who only a couple weeks ago were screaming for a a bear market at 5400. I do not like such obvious plays and will not mind a little bit of froth coming out, but more on this later, if and when we do get there.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.